This week, the price of Polygon surged, buoyed by the robust performance of Polymarket and the popularity of Pokemon Cards.

Polygon (POL) climbed to a peak of $0.4200, marking an increase of over 12% in the past week, which raised its market capitalization to more than $1.3 billion.

This growth followed the network’s upgrade and the transition of its token from MATIC to POL. Post-upgrade, POL became the native and staking token for the Polygon Proof-of-Stake network. In upcoming developments, it will serve as the primary token for the AggLayer.

The resurgence of the token is also linked to the ongoing expansion of its ecosystem. Polymarket, one of the leading prediction platforms, has experienced notable growth in recent months. According to data from SimilarWeb, the platform recorded over 13.8 million visits in August, a 52% rise compared to the previous month.

Additionally, the funds circulating within the network are on the rise. The prediction market for the winner of the presidential election has close to $900 million in assets, while the market for popular winner predictions boasts $201 million.

According to DeFi Llama, Polymarket now holds over $122 million in total value locked and commands a market dominance of 82% within the prediction sector. This upward trend is expected to persist as the platform gains mainstream attention, receiving mentions from major media like CNN and Bloomberg.

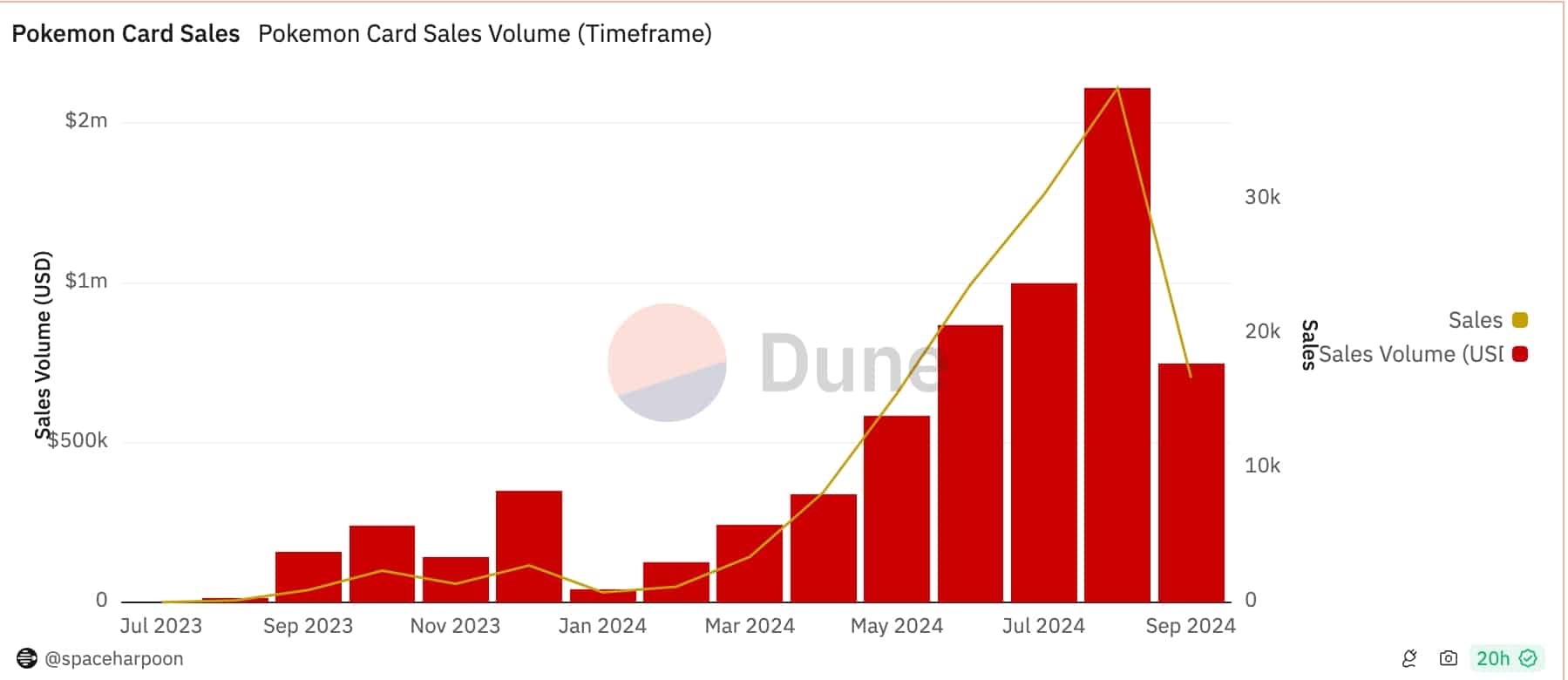

In the meantime, the NFT sales of Pokemon Cards are performing quite well. Data from Dune Analytics indicates that the monthly sales volume peaked at $1.6 million in August, a rise from $1 million the month before. So far this month, sales have totaled $749,000.

Additionally, the total value locked in Polygon’s Decentralized Finance ecosystem increased by 2.46% to reach $861 million over the last month. Conversely, the Ethereum (ETH) value decreased by 10%, while Arbitrum and Base saw declines of more than 2% during the same timeframe.

Nonetheless, Polygon’s share of the decentralized exchange market is facing a downturn. The volume of trades on its blockchain fell by 12.2% over the past week to $476 million, while Base and Arbitrum, two other prominent layer-2 networks, processed $3.18 billion and $3.2 billion, respectively, in the same period.

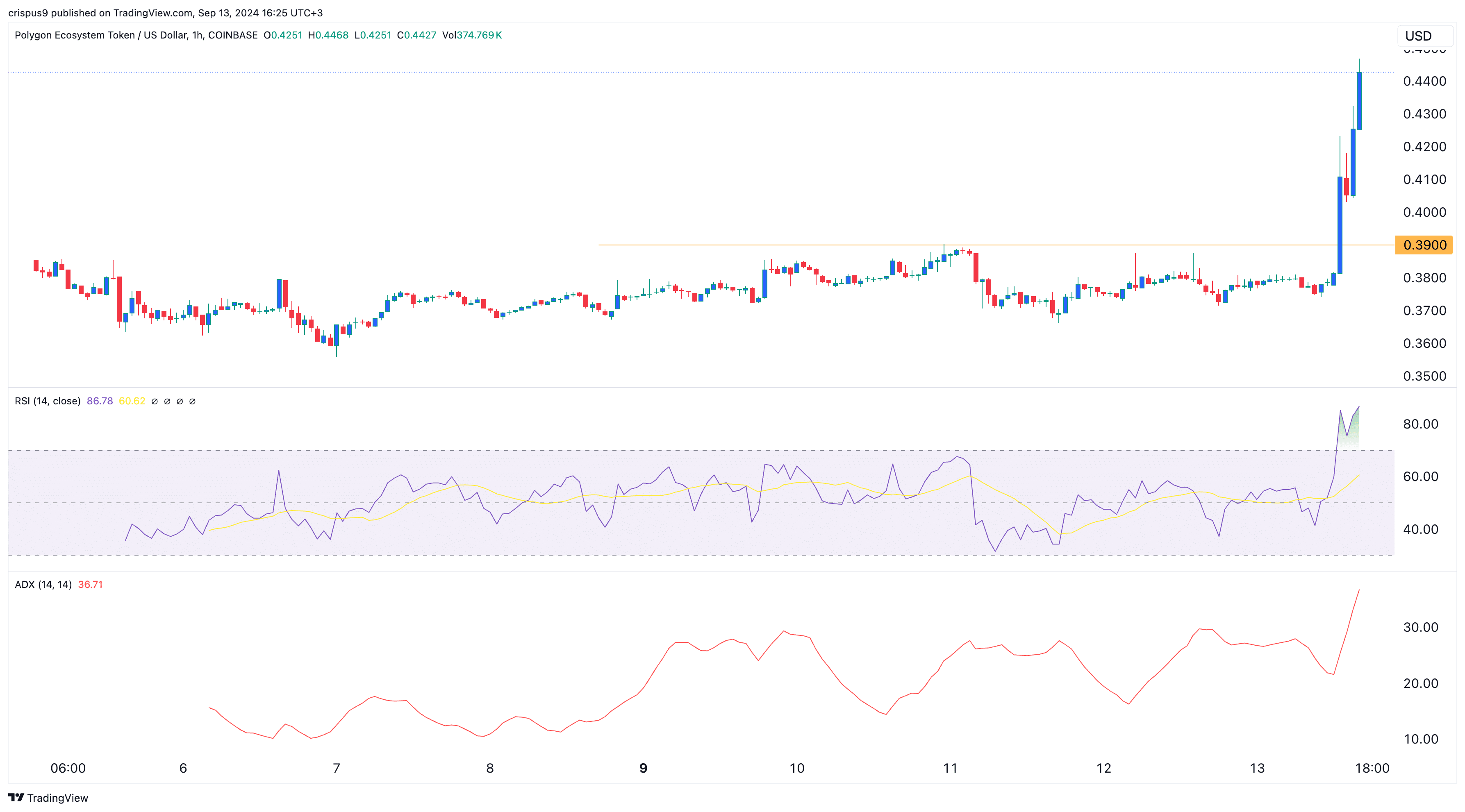

Polygon breaches key resistance, may be overbought

After its launch last week, the POL token experienced a consolidation phase that concluded on Friday, Sept. 13, when it skyrocketed past the vital resistance level of $0.3900, its peak recorded on Sept. 10.

The Average Directional Index, a widely-used trend indicator, climbed to 36, while the Relative Strength Index reached a high of 87, indicating an overbought situation. Therefore, POL might soon experience a pullback as profit-taking occurs, potentially retesting support at $0.40.