Life represents evolution, change, adaptation, and the desire to thrive. Throughout history, we have faced countless changes that compelled society to adapt, evolve, and grow. From the dawn of trade to the COVID-19 pandemic and beyond, we have witnessed transformative events that shaped the world. Finance stands out as one of the most significant and influential sectors. The landscape of finance has been molded by critical events that have affected economies, influenced policies, and altered the trajectory of global markets. Among the remarkable advancements in the last 15 years is the advent of Bitcoin and the rise of the cryptocurrency industry.

The cryptocurrency sector, while not universally accessible yet, has experienced extraordinary growth and transformation since Bitcoin was introduced in 2009. In subsequent years, it emerged as a vibrant and impactful force, capturing the attention of investors and enthusiasts around the globe. In this article, I will present my perspective on why cryptocurrencies are poised to become a stable market, potentially supplanting traditional financial and banking systems. This discussion will address essential topics such as safety, the circular economy, and sustainability, which, when combined with high-potential ventures like Data Centers, will help define the new future.

Crypto Infrastructure and Energy Consumption

The servers that underpin the cryptocurrency infrastructure are mainly employed for mining, transaction verification, executing smart contracts, and hosting decentralized applications (DApps). These servers usually have the following specifications:

• High-performance CPUs and GPUs

• Extensive memory and storage capacity

• Advanced networking features

• Strong security measures

These characteristics lead to costly, high-power-consuming servers. Consequently, there is a need for a robust and reliable environment to house these servers and ensure their proper functioning.

Energy Consumption

Data transmission now accounts for nearly 3% of the total electricity consumed worldwide. To guarantee that data is transmitted properly and stored and processed correctly, we rely on physical locations called data centers. These facilities are considered mission-critical. But what makes data centers essential? Mission-critical facilities are broadly characterized as operations that, if disrupted, could harm business activities, leading to revenue loss, legal issues, and in extreme cases, loss of life. Examples of such facilities include data centers, hospitals, laboratories, and military bases.

Data center facilities are strictly regulated by various organizations and standards pertaining to both physical and data infrastructures. This rigorous regulation is vital because any data loss can have devastating effects on millions due to the sensitivity of the information stored. Gradually, the blockchain industry alongside emerging sectors like Artificial Intelligence (AI) is playing an increasingly crucial role in the modern landscape. The demand for distributed infrastructures to store nodes that validate crypto transactions and manage smart contracts is surging.

Are Current Data Centers Ready for Blockchain Technology?

Blockchain brings forth challenges not only for Mechanical, Electrical, and Plumbing (MEP) infrastructure but also for broader enterprise infrastructure. To support the demanding workloads connected to blockchain technology, facilities must enhance both infrastructure security and MEP capabilities. Currently, the average power density in a data center hovers around 10 kW per rack. For context, several reports suggest that the typical U.S. household using electricity for heating and hot water consumes approximately 10,715 kWh per year. A single rack in a data center, by contrast, consumes nearly nine times more power annually (8,760 kWh per year), with some facilities engineered to provide peak power exceeding 100 MW.

Building these facilities necessitates significant capital investment, and at times, the operational efficiency of the facility may not meet expectations, leading to escalated data management costs. One challenge facing contemporary data centers is partial loads, meaning if the facility consumes a specified amount of watts, the original design was intended for one and a half times that power. This results in reduced performance and efficiency. The closer the facility’s consumption approaches its intended energy use, the simpler it becomes to enhance and manage overall efficiency.

The key distinction between blockchain and traditional data processing lies in decentralization. In a decentralized framework, the failure of a single node doesn’t compromise the performance of the entire digital infrastructure; however, in conventional systems, the failure of a node can lead to significant, irreversible harm to many businesses. This requirement for high dependability and redundancy explains why data centers typically incur substantial initial costs (CAPEX) and incorporate multiple security layers to ensure ongoing operation, even amid equipment failures.

Nonetheless, the decentralization inherent in blockchain technology offers a unique advantage: it mitigates the necessity for costly and redundant facilities to host all crypto servers, as the failure of certain nodes does not disrupt the entire system. This leads to the critical inquiry: how can traditional data transmission methods be integrated with emerging blockchain technology?

Combining Current Needs with New Crypto Demands

In the data center realm, the “Tiers” terminology as defined by the Uptime Institute is widely recognized and applied globally. This classification system resembles the redundancy levels outlined by TIA or BICSI standards. While established professionals in the data center market are acquainted with these Tiers, here’s a brief overview for cryptocurrency users unfamiliar with this terminology: There are four Tiers, each signifying a different redundancy level within a facility:

1. Tier I: No redundancy.

2. Tier II: Redundancy.

3. Tier III: Concurrently maintainable.

4. Tier IV: Fault-tolerant.

These Tiers also relate to the initial investment necessary for establishing the facility. Advancing from one Tier to another typically involves doubling the capital expenditure (CAPEX). Most data centers are classified as Tier III, indicating that they are designed to be concurrently maintainable. This ensures that the facility can be kept in optimal condition to prevent failures at any time. It’s important to recognize that certain IT equipment housed in a data center is vital for our day-to-day operations; even traffic signals rely on these services.

For blockchain infrastructure, there isn’t a necessity to significantly escalate CAPEX to ensure that the equipment operates effectively. It is important to place the servers in an environment where they can function effectively with minimal downtime. Since the loss of individual servers does not compromise the functionality of the entire blockchain, these operations do not necessitate high availability. Although downtime can affect users who earn revenue through transaction validation, it is essential to evaluate whether the costs associated with reducing downtime warrant the augmented CAPEX.

Consequently, the Tier classification of these facilities can be lessened. In non-critical areas of the data center that are not essential for powering the crypto nodes, the Tier could be downgraded to Tier II or even Tier I. This strategy optimizes resources without undermining the overall blockchain infrastructure.

Crypto Mining as a Sole Business?

To support our preceding discussions and stimulate new ones, consider the following data: Following the Bitcoin halving on April 20, 2024, the return on investment (ROI) for each miner has shrunk by 50%, regardless of fluctuations in total hashrate or Bitcoin prices. This change tightens the overall financial outlook. For example, a miner costing $2,000, delivering 120 TH/s, and necessitating no added capital expenditures (CAPEX) beyond the miner itself now confronts this reduction in ROI.

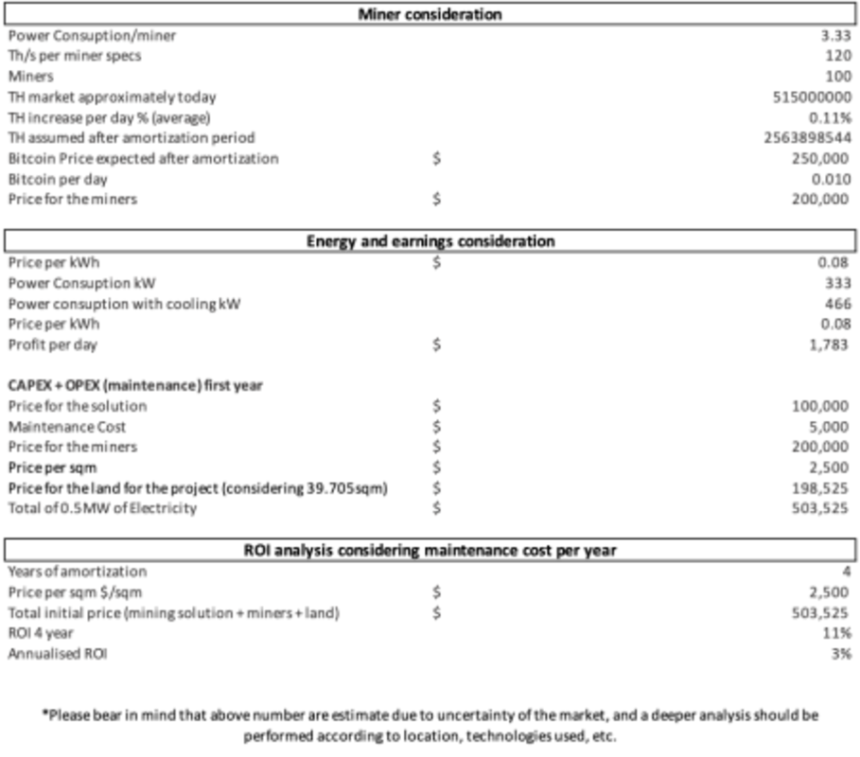

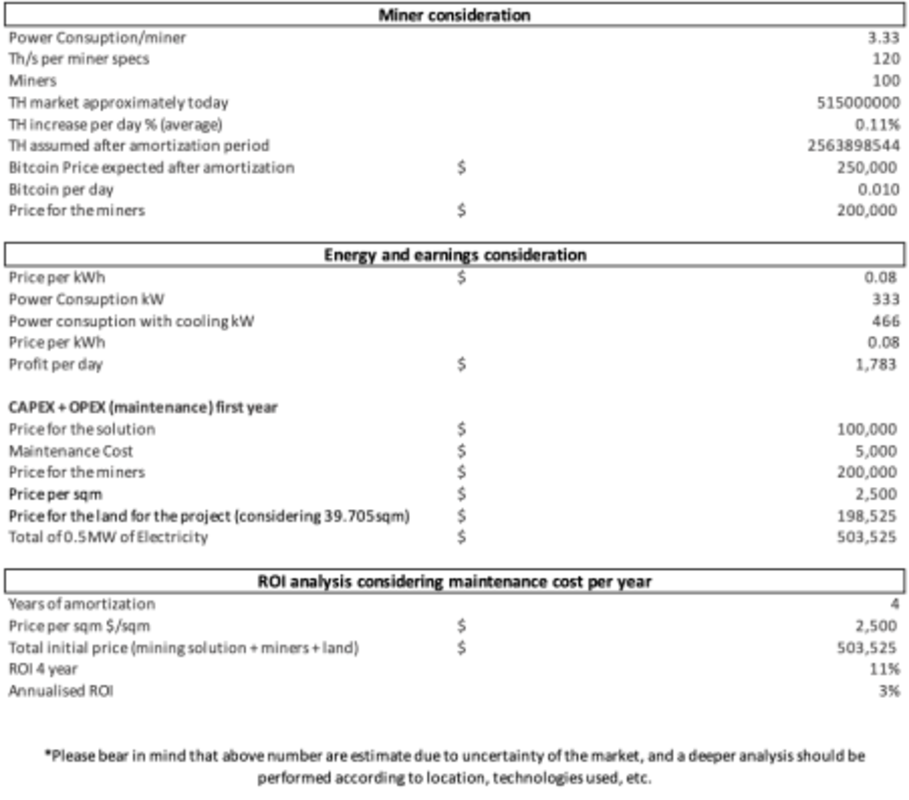

For a setup comprising 100 miners, the overall CAPEX investment for the entire facility (including land for one container, MEP infrastructure, and the miners) is estimated around $503,000. The following analysis demonstrates the approximate ROI over the next four years (until the subsequent halving) for a facility operating 100 miners, each consuming 3.3 kW with a price per kilowatt hour equal to 0.08$. To enhance accuracy, this evaluation presumes a 50% annual increase in hashrate and employs traditional air cooling solutions. The projected future Bitcoin price utilized in this analysis is $250,000, based on various studies and speculations.

The anticipated ROI over the next four years, assuming a future Bitcoin price of $300,000, indicates that crypto mining alone may not constitute a highly lucrative business. This provokes the question of why companies continue to invest in crypto mining. The response lies in speculation. During periods of bullish trends, crypto facilities proved to be highly profitable; however, these facilities now require additional revenue streams.

Heat Reuse: A Disruptive Side Hustle

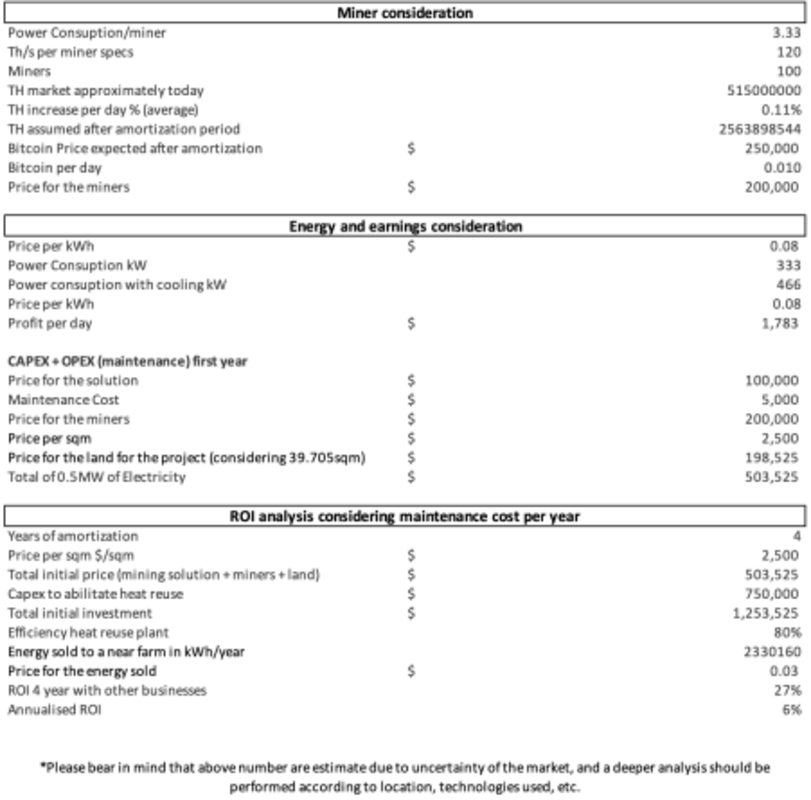

One innovative side venture involves transforming these facilities into energy-generating establishments. A significant portion of the power consumed by miners and servers is converted into heat. What if we could harness that heat and sell it as energy? For instance, selling this energy to a nearby farm for greenhouse heating at $0.03/kWh could enhance the business model’s viability. Considering a presumed additional investment of $750,000 (bear in mind that this extra cost must be evaluated according to facility limitations, and a rough estimate has been applied for illustrative purposes).

Your initial examination suggests that this business model could be feasible. The incorporation of a heat reuse side business has effectively augmented the return on investment (ROI). Notably, the ROI calculation spans a four-year horizon, coinciding with the subsequent Bitcoin halving event. While the facilities may become less than optimal for the same cryptocurrency operations following the halving, the infrastructure will still retain value for selling the generated heat.

Additionally, if we contemplate merging this model with the data center sector, the ROI extends well beyond the next four years. This signifies a long-term investment where the efficient usage of electricity could increasingly matter.

Conclusion

The crypto industry is becoming more integral to our lives. Numerous companies are incorporating stablecoins into their portfolios as financial assets, and new blockchain technologies are emerging that will necessitate specialized facilities akin to existing data centers (such as BlockDAG architecture, Ordinals/NFTs, BRC20, and notably, Runes).

We find ourselves at the onset of a market destined to persist and reshape the contemporary landscape. The integration of traditional data centers with crypto-specific domains to facilitate additional operations like heat reuse is likely imminent, marking a shift towards sustainability. Those who spearhead this transformation will reap the greatest rewards.

This is a guest post by Jose Farrona. Opinions expressed are entirely their own and do not necessarily reflect those of BTC Inc or Bitcoin Magazine.