The price of Bitcoin has surged by 10% over the last week, recently surpassing the $67,000 threshold once again in the hours leading up to now. The Coinmarketcap Fear and Greed Index has shifted to a state of greed due to the strong buying pressure and shows no indications of a slowdown.

The intensity of buying pressure on Bitcoin has escalated significantly in recent days, resulting in a considerable decrease in the amount of BTC available on cryptocurrency exchanges. According to on-chain metrics, this has led to Bitcoin’s exchange reserve hitting its lowest level in five years.

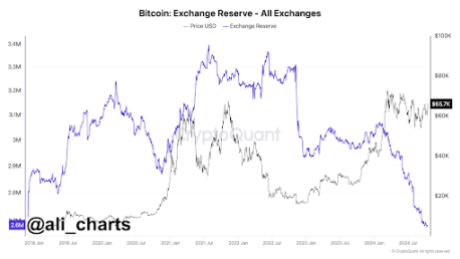

Bitcoin Exchange Reserve Hits 5-Year Low

In recent days, the demand for Bitcoin has surpassed its supply, causing a rapid decline in exchange reserves. As per CryptoQuant data shared on social media platform X by cryptocurrency analyst Ali Martinez, the number of BTC on exchanges has dropped to a five-year low of 2.6 million BTC.

Related Reading

Martinez’s chart illustrates an interesting trend in Bitcoin’s exchange reserves that has developed over the course of the year. At the start of 2024, reserves were approximately 3.05 million BTC. However, this figure has seen a notable decline since then.

The decreasing supply of Bitcoin on exchanges can be linked to several key factors. Primarily, there’s been a significant rise in interest from institutional investors, especially following the approval and advancing momentum of Spot Bitcoin ETFs, which have triggered substantial buying activity, with US-based Spot Bitcoin ETFs now ranking as the second-largest holders of BTC following Satoshi Nakamoto.

Moreover, many long-term holders have added to the buying momentum, as they kept purchasing in large quantities. Even during price corrections and sell-offs from short-term holders, more BTC were seen moving into stable long-term ownership, which is less likely to lead to sales.

Consequently, the total Bitcoin held on cryptocurrency exchanges has decreased by around 450,000 BTC since January, reducing the current reserve to merely 2.6 million BTC. This represents the lowest level observed since January 2019, and such a steep drop usually indicates a bullish outlook for Bitcoin. “We are all aware of what this implies,” Martinez stated.

What Does This Imply for Bitcoin Price?

The current condition of Bitcoin’s exchange reserves indicates that market participants are increasingly opting to hold onto their BTC, anticipating future profits, as speculation about the Bitcoin price trajectory continues in the next few months.

Related Reading

With fewer coins available on exchanges, it typically suggests diminished selling pressure, which tends to push the price upward as demand keeps increasing.

Uptober is now fully underway, and Bitcoin has already gained 6.3% this month. As of this writing, Bitcoin is trading at $67,200. This significant price level positions Bitcoin close to breaking its all-time high of $73,737 before the end of October.

Featured image created with Dall.E, chart from Tradingview.com