Coinspeaker

Bitcoin Stabilizes Around $68K as Whales Reduce Holdings

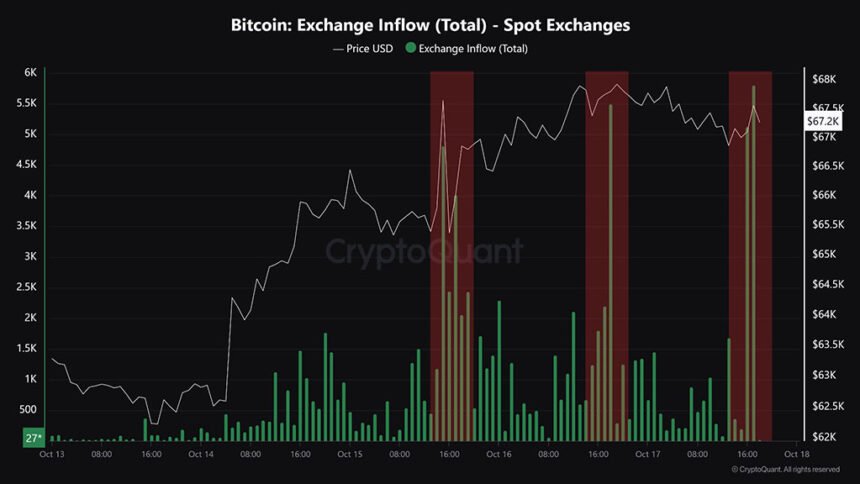

Since October 16, Bitcoin (BTC) has been stabilizing near $68K after an early-week surge fueled by robust spot market demand. However, some investors seemed to be taking profits from this price increase, as indicated by increases in exchange inflow. The rise in exchange inflow suggests that more BTC was transferred to centralized exchanges for selling. This could clarify the minor decline to $66K witnessed on Thursday.

Source: CryptoQuant

Interestingly, the slight drop to $66.6K was also characterized by whales reducing their long positions. This was reflected by the slight decrease in the Whale vs Retail Delta on Binance exchanges (green bars pulling back). This metric monitors the accumulation of whales in comparison to retail investors. Its decline indicates diminished whale-long positions, a pattern that aligns with BTC price corrections.

In other words, the recent data revealed that smart money on Binance was slightly derisking, potentially concerned that the downturn could extend below $66K.

Source: Hyblock

Nonetheless, this week’s surge bolstered the optimistic ‘Uptober’ sentiment following a sluggish start earlier in the month. The risk-on and bullish attitude was also evident among US spot ETF products, which enjoyed four straight days of gains since October 11. On Thursday, these products recorded net inflows of $470.48 million.

According to QCP Capital, a crypto trading firm based in Singapore, the robust flows might propel BTC towards its March all-time high.

“The strong and escalating inflows may serve as a leading indicator of further rallies as BTC heads back to its all-time high of $73,790,” the firm stated in its daily update.

Source: Soso Value

The trading firm also highlighted that its trading desk experienced increased demand for long-dated options, particularly those set to expire in March 2025.

“The desk noted significant buying of long-dated March 28 options during US trading hours, with 600 contracts at a 120k strike. This indicates that optimistic, long-shot buyers are reentering the market amid this rally,” added QCP Capital.

This suggests that options market traders remain bullish on BTC price forecasts for Q4 2024 and Q1 2025. However, short-term market uncertainty persists due to the earnings season and the upcoming US elections.

Given BTC’s positive correlation with US equities, the earnings season could influence asset price movements, particularly with MicroStrategy’s earnings report anticipated on October 30th.

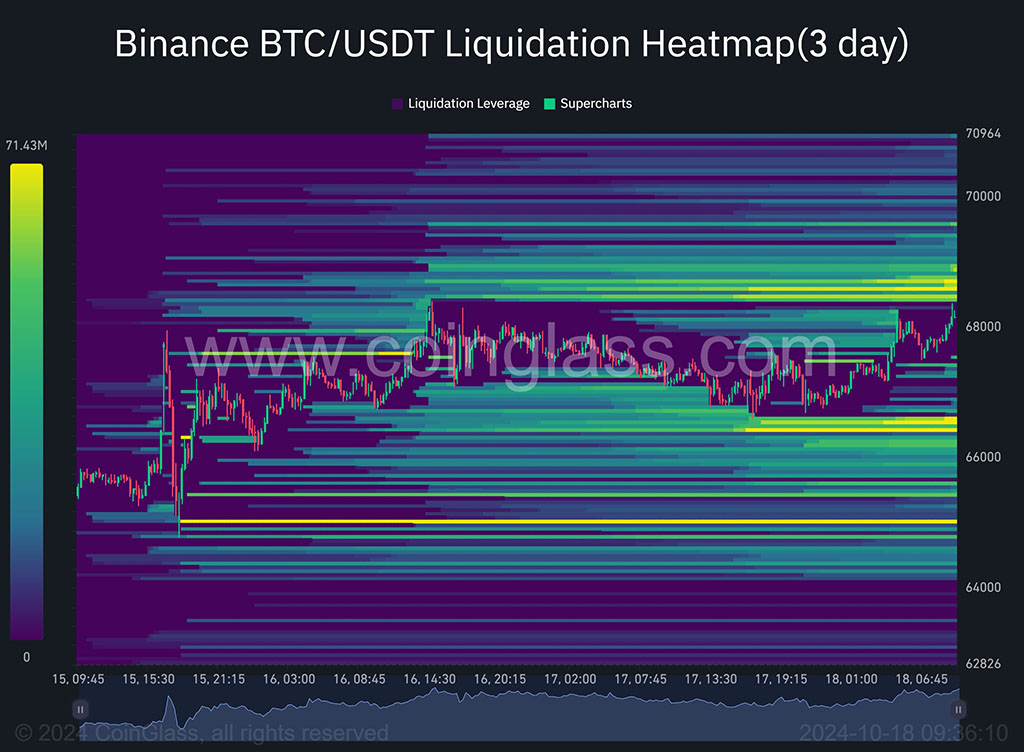

Source: Coinglass

That said, the liquidation heatmap indicated that considerable short positions were accumulating around $68.6K and long positions at $66.4K. Market makers generally employ these liquidity clusters (bright yellow levels) to manipulate prices and tend to steer BTC price direction towards these levels. Hence, they could be crucial levels to monitor in the near term.