The price of Ethereum (ETH) is currently at a pivotal point, lingering around significant resistance and support levels. Recent market indicators, such as the Net Unrealized Profit/Loss (NUPL) and whale activity, imply a cautious outlook among investors.

Market participants are monitoring essential price points, as a breakout above $2,500 might ignite a rally, whereas a failure to maintain support at $2,000 could trigger a deeper decline.

ETH NUPL Indicates Caution in the Market

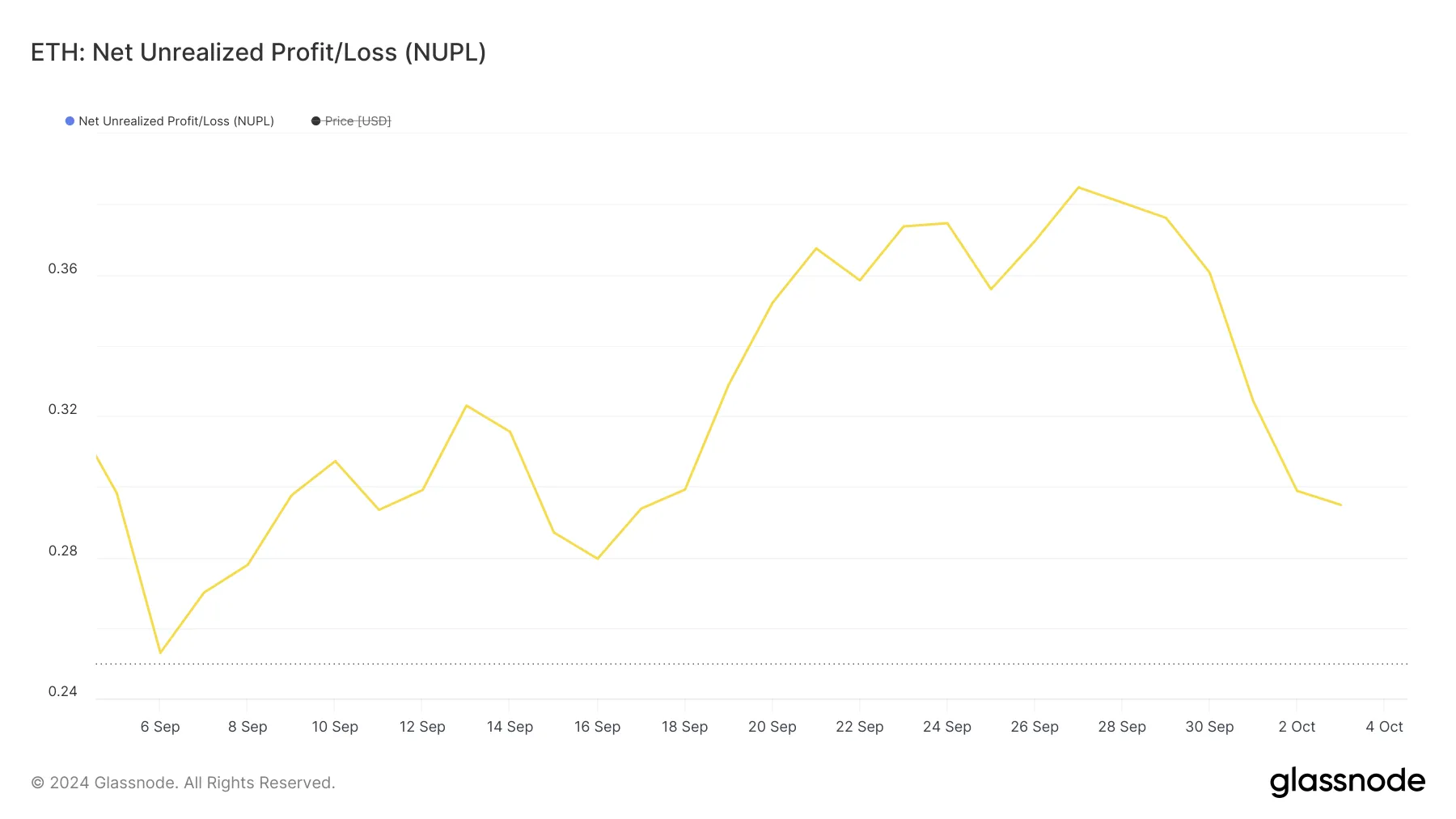

The current Net Unrealized Profit/Loss (NUPL) for Ethereum is recorded at 0.29, which indicates that a fair portion of ETH holders remains in profit, yet the market sentiment is notably cautious.

NUPL serves as a tool to assess the market’s overall profit or loss by calculating the difference between ETH’s current price and the price at which it was previously moved. This metric effectively captures unrealized gains or losses among market participants and stands as a fundamental indicator of market sentiment.

A higher NUPL value suggests that most holders are in profit, reflecting optimism, while a lower NUPL indicates growing unrealized losses, which could lead to increased selling pressure. Throughout September, the Ethereum market underwent several fluctuations, with NUPL momentarily escalating to 0.36 before experiencing a sharp decline toward month-end.

Read more: Investing in Ethereum ETFs

This oscillation reflects attempts at recovery that ultimately faltered as market confidence diminished, leading more participants to hold ETH at a loss. The most recent drop in NUPL from 0.36 to 0.29 indicates a shift towards a more bearish sentiment.

While some holders are still in profit, an increasing number are facing losses, which could lead to additional downward pressure unless a significant market catalyst emerges to reverse the trend.

Ethereum Whales Display Hesitance

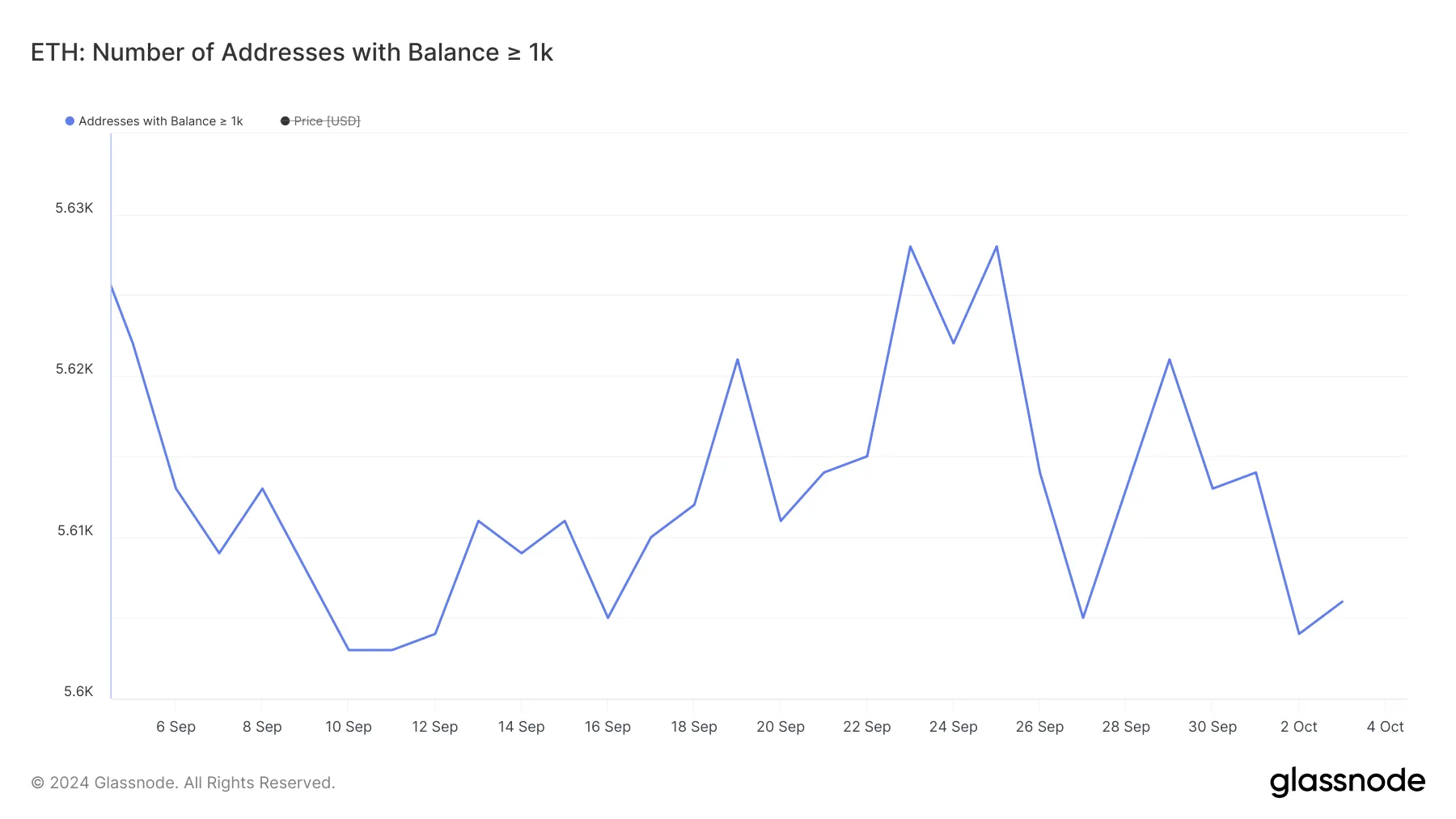

The number of Ethereum addresses holding at least 1,000 ETH reached a peak of 5,628 on September 25, highlighting a significant period of whale accumulation that typically indicates bullish sentiment or market confidence. However, this figure has seen a slight decrease, now at 5,606, down from 5,621 just four days prior.

Monitoring the actions of these large holders is crucial, as whales possess the capital to influence market prices. Their accumulation of ETH can create upward price pressure, signaling confidence in future price increases. Conversely, a reduction in their holdings may reflect caution or a shift towards a more bearish perspective.

However, the current slight decline in whale addresses does not indicate a mass exodus or widespread sell-off. The data suggests that whales are taking a wait-and-see stance, modestly adjusting their positions without instigating major market upheaval.

This behavior signals a phase of uncertainty in the market, where participants are hesitant to make decisive moves in either direction. Even though whale accumulation has decreased, the gradual nature of this decline implies an absence of overwhelming bearish sentiment.

ETH Price Outlook: Significant Support and Resistance Levels Nearby

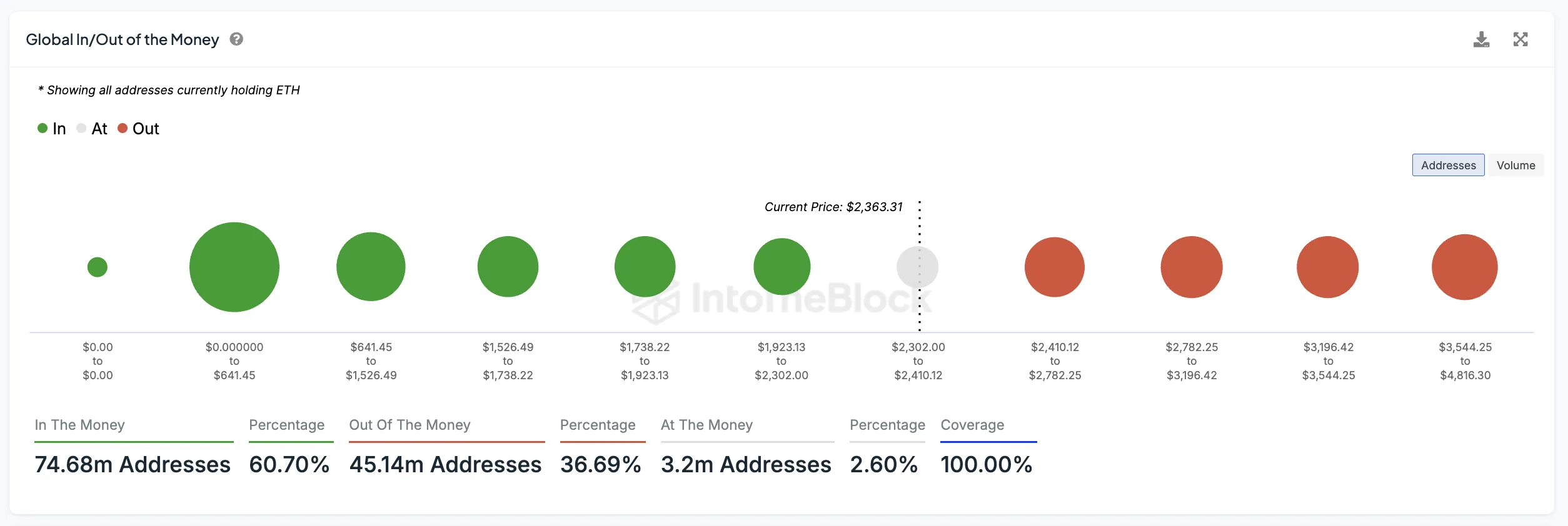

The ETH Global In/Out of the Money metric reveals that Ethereum is currently experiencing strong resistance and support levels close to its existing price. This reinforces the notion that ETH may trade sideways in the approaching days before establishing a definitive direction.

This metric illustrates the distribution of addresses either in profit (in the money) or in loss (out of the money) based on the present price. It highlights areas where buying and selling pressure is likely to concentrate, assisting traders in identifying crucial price levels where ETH may face substantial resistance or support.

Read more: Ethereum (ETH) Price Predictions for 2024/2025/2030

Should Ethereum manage to breach the $2,500 barrier, it may further ascend beyond the $3,000 range, hitting considerable resistance until approaching $3,200. Conversely, if ETH cannot maintain the critical support level at $2,000, it risks deeper corrections, potentially falling back to the $1,700 range.

Disclaimer

In accordance with the Trust Project guidelines, this price analysis is intended for informational purposes only and should not constitute financial or investment advice. BeInCrypto is dedicated to providing accurate, impartial reporting, but market circumstances can change without prior notice. It is essential to conduct your research and consult with a professional before making any financial decisions. Please be informed that our Terms and Conditions, Privacy Policy, and Disclaimers have recently been updated.