Stablecoins Reach a Critical Mass as Bank of England Advocates for Regulation

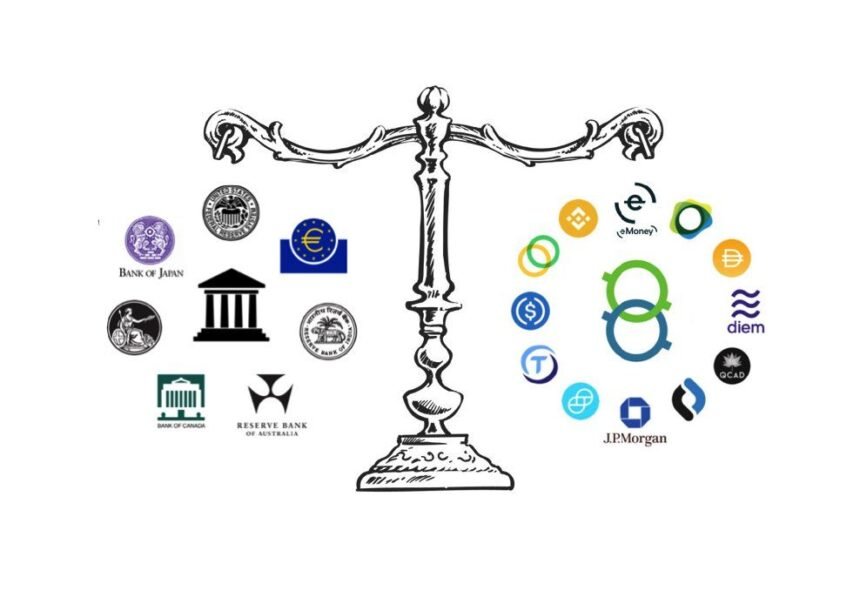

The expansion of public blockchain technology and the rapid growth of Global Stablecoins is paving the way for a significant shift in digital currency usage, driven by improvements in user experiences, blockchain efficiency, and regulatory frameworks.

The Bank of England (BoE) has released a paper analyzing the potential advantages of new digital payment methods, asserting that stablecoins—often pegged to fiat or other assets and issued by private entities—should adhere to the same regulatory framework as traditional bank deposits.

The document, titled “New forms of digital money,” covers central bank digital currencies (CBDCs) as well as various digital asset types, which include stablecoins.

Andrew Bailey, the Governor of the Bank of England, remarked:

“We exist in a progressively digitized world where our payment methods and money usage are evolving swiftly. The emergence of stablecoins for transactions and the evolving concepts of CBDCs has raised several pressing questions that central banks, governments, and society at large must thoughtfully consider. It’s crucial that we address the challenging and significant questions regarding the future of these digital currencies.”

Nonetheless, the U.K.’s banking regulator further emphasized that for these new types of digital currencies to achieve mainstream acceptance, the public must possess the same level of trust in them as they do in traditional money.

This means stablecoins must consistently and credibly promise to be entirely interchangeable with existing monetary forms and must be sufficiently anchored to instill equal confidence among users as that of commercial bank money.

To enhance trust in stablecoins as comparable to commercial bank money, the bank has proposed specific guidelines for stablecoin issuers.

- Stablecoins must consistently and credibly promise full interchangeability with existing currency forms

- Stablecoins intended for monetary use should meet the same standards as commercial bank money

- Stablecoins categorized as “systemic” should maintain stable value consistently, with guaranteed 1-to-1 redemption and robust legal claims

Post-release of the BoE discussion paper, Christina Segal-Knowles, executive director of the Bank of England’s Financial Market Infrastructure Directorate, delivered a speech at the Westminster eForum Policy Conference titled “What’s Old is New Again” to temper some of the enthusiasm and concerns surrounding the topic.

The Bank of England (BoE) executive director mentioned,

“Stablecoins and central bank digital currencies (CBDCs) do not inherently threaten financial stability, even if they replace bank deposits.”

Narrowing her focus to stablecoins meant for transactions, Segal-Knowles asserts that financial regulators clearly understand the requirements needed to ensure that private currency is secure and dependable for public use,

“Stablecoins do not launch us into an entirely new realm. The critical point is to ensure that we do not misinterpret the risks they pose simply due to appealing technology. A broader adoption of stablecoins and CBDCs does not inherently create a risk to financial stability, provided it is executed in an orderly fashion.”

According to Segal-Knowles, stablecoins do not present any new challenges. They are fundamentally akin to traditional forms of private money held by consumers and enterprises in commercial banks.

“This indicates that we will enforce standards similar to those applicable to existing private currencies, irrespective of the technology employed or the legal status of the issuing entity.”

In a recent address focusing on the same topic, Bank of England Deputy Governor Sir Jon Cunliffe adopted a slightly different perspective, suggesting that the growing transition from public to private monetary forms indeed brings substantial concerns for state authorities and central banks.

Cunliffe hinted that technology-driven changes and the evolving use of various money forms, including non-bank private currencies, could necessitate broader access to a digital form of central bank money to uphold future financial stability.

The need for regulation remains urgent, particularly as some governments eagerly embrace cryptocurrencies (despite their volatility). A notable example is El Salvador, which has declared bitcoin as legal tender, equivalent to the U.S. dollar (the official currency).

In the United States, the Federal Reserve is conducting research on a digital dollar, collaborating with external parties, and planning public engagements as it evaluates the feasibility of a CBDC.

Recently, during the G7 assembly of finance ministers, a statement regarding CBDCs was released:

“G7 Central Banks have been examining the opportunities, challenges, and the implications for monetary and financial stability associated with Central Bank Digital Currencies (CBDCs), and we commit to collaborating, as Ministries of Finance and Central Banks, within our respective mandates, on their broader public policy impacts. We acknowledge that any CBDCs, as a type of central bank currency, could serve as both a secure settlement asset and a foundation for the payments ecosystem.”

Moreover, the Bank of International Settlements (BIS) has indicated that cryptocurrencies should be classified into two categories and has sought feedback on this matter. The BIS’ Basel Committee released a statement proposing that these crypto categories include stablecoins and tokenized assets, which would qualify for assessment under the Basel Framework, establishing standards for banking oversight.

The Federal Reserve intends to publish a report this summer to evaluate the advantages and risks associated with a digital dollar. The BoE has invited views from stakeholders on the discussion paper and is among leading central banks worldwide assessing the potential issuance of digital fiat to enhance payment systems. The BOE stated it has yet to make a determination on whether to launch its own central bank digital currency, or CBDC, a concept dubbed ‘Britcoin’ by finance minister Rishi Sunak when he requested the BoE to explore this in April.

Sources:

Bank of England Discussion Paper ‘New forms of digital money’ – Published on 07 June 2021

https://www.bankofengland.co.uk/paper/2021/new-forms-of-digital-money

Bank of England Speech ‘Stablecoins: What’s Old is New Again’ – Westminster eForum Policy Conference -10 June 2021

https://www.bankofengland.co.uk/-/media/boe/files/speech/2021/june/stablecoins-whats-old-is-new-again-speech-by-christina-segal-knowles.pdf?la=en&hash=E1D88DB050EB92BA8C581A9C8A967BE7191F776A

Bank of International Settlements BIS – Basel Committee on Banking Supervision – Consultative Document Prudential treatment of cryptoasset exposures – 10 June 2021

https://www.bis.org/bcbs/publ/d519.htm