- The market dominance of Ethereum has declined to a low range of 13%.

- This reduction in market share is occurring alongside diminished demand, increased supply, and a growing dominance of Bitcoin.

Over the past year, Ethereum [ETH] has been lagging behind Bitcoin [BTC]. For example, Bitcoin has risen over 120% year-on-year (YoY), while Ethereum has only seen a gain of about 50%.

Ethereum’s decline in performance has led to its market dominance dropping significantly. Currently, it stands at 13.85%, a substantial decrease from its yearly peak of nearly 20%.

Source: TradingView

A variety of factors are contributing to the decreasing dominance of the largest altcoin and its performance relative to Bitcoin.

Bitcoin’s increasing dominance

The dominance of Bitcoin has seen a remarkable rise this year, forming higher peaks and operating within an ascending channel since the beginning of the year.

Source: TradingView

A significant reason for the increase in Bitcoin’s dominance is the high interest in spot Bitcoin exchange-traded funds (ETFs).

According to data from SoSoValue, spot Bitcoin ETFs currently hold more than $57 billion in BTC. This indicates substantial institutional interest, driving positive price performance.

Whales are offloading Ethereum

Another element leading to Ethereum’s declining dominance is the activity of large investors selling off their holdings.

On October 8th, a significant address that took part in the 2014 Initial Coin Offering (ICO) transferred 5,000 ETH to Kraken, valued at $12 million.

This whale has deposited around 50,000 ETH worth approximately $125 million onto exchanges over the last two weeks, according to SpotOnChain.

Additionally, the Ethereum Foundation has participated in selling, contributing to Ethereum’s downturn. Since the year’s start, it has offloaded over $10 million worth of ETH.

If whale selling persists without an increase in demand, ETH might continue to trade in a limited range if new buyers don’t enter the market.

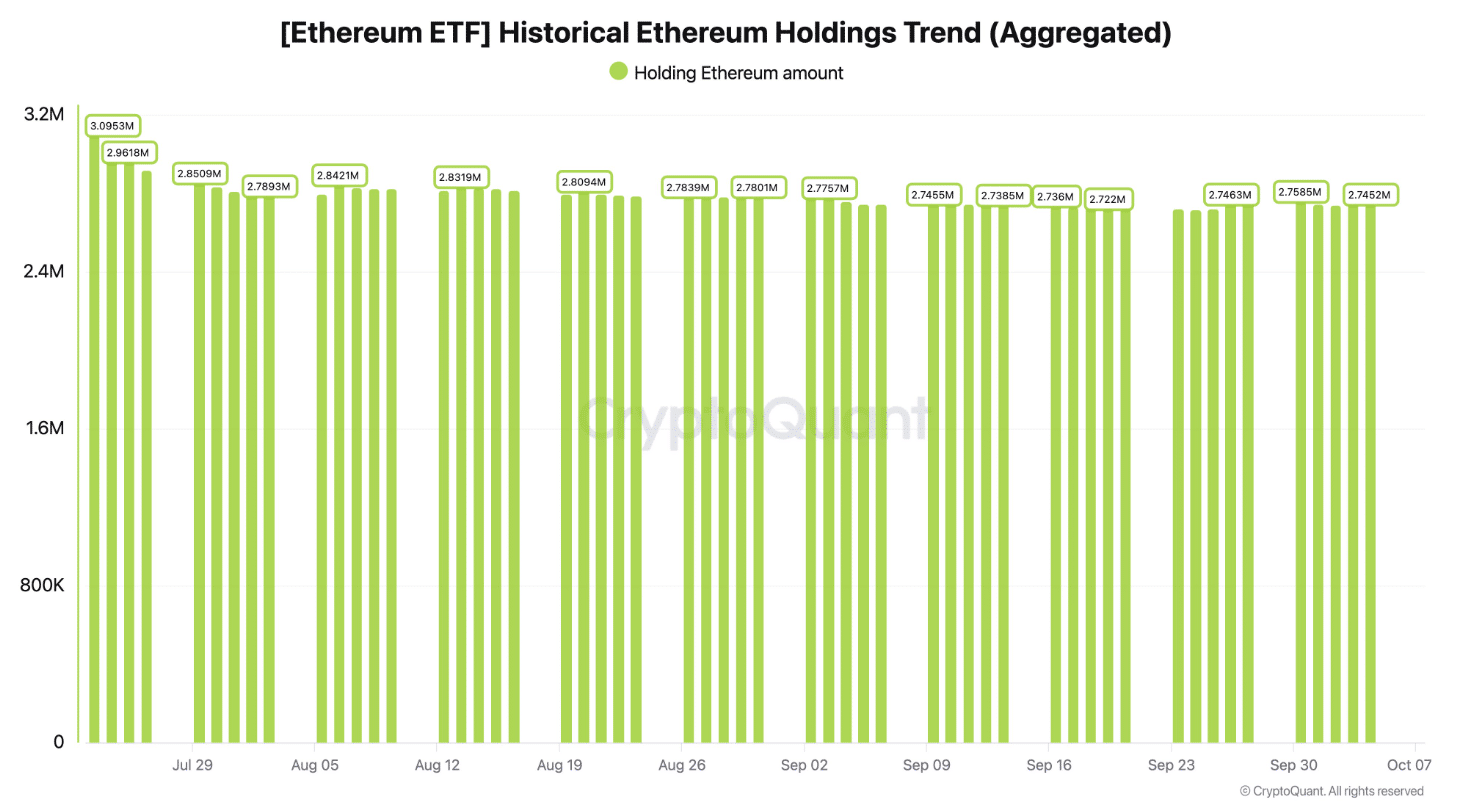

Low demand for ETH ETFs

Contrasting Bitcoin, Ethereum has seen a lack of demand for its spot ETFs. Data from CryptoQuant reveals that since their launch in July, these ETFs have experienced $849 million in outflows.

Source: CryptoQuant

The outflows are largely attributed to the Grayscale Ethereum Trust, and the ETFs are facing difficulties attracting new investments.

Notably, the BlackRock spot ETH ETF has seen no inflows over the past two days, while the Fidelity Ethereum Fund has recorded no positive inflows this month, according to SoSoValue.

This lack of demand has hindered Ethereum from making gains, exacerbating the decline in its market dominance.

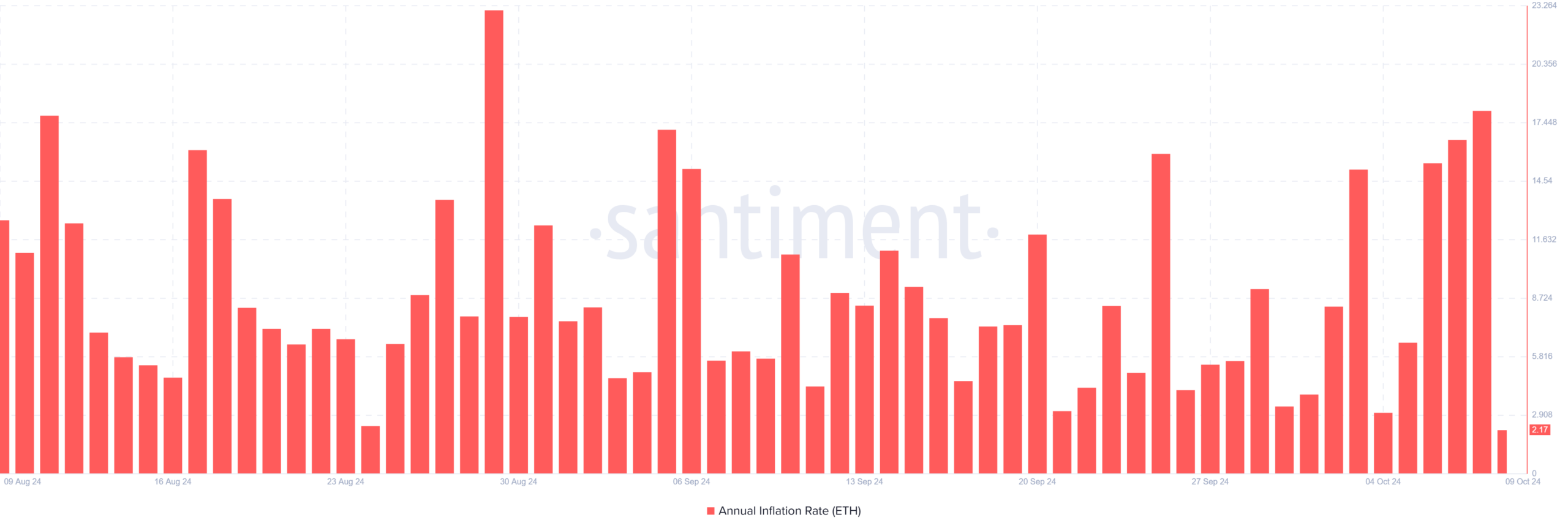

Increased supply

Ethereum is also facing challenges with a decrease in its burn rate, leading to inflation. Data from Ultrasound Money indicates that over the last 30 days, more than 43,000 ETH tokens have been added to the circulating supply.

Furthermore, data from Santiment shows that Ethereum’s annual inflation rate has recently surged to 18%, marking the highest level since August.

Source: Santiment

View Ethereum’s [ETH] Price Forecast for 2024–2025

Without new demand to counterbalance this increasing supply, sell-side pressure on Ethereum is likely to intensify, causing it to cede market share to Bitcoin and various altcoins.

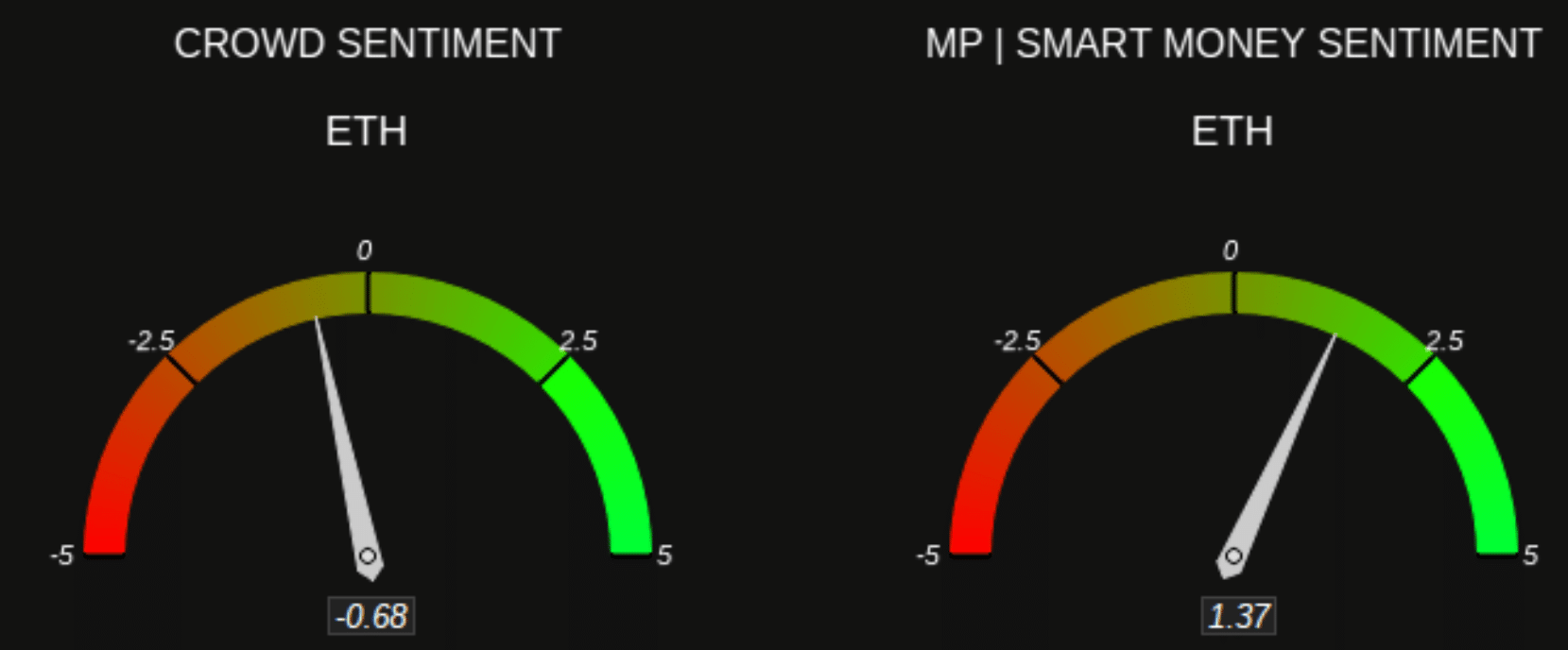

The reduction in Ethereum’s dominance has also led to a downturn in market sentiment. According to Market Prophit, a majority of traders are pessimistic about Ethereum, while institutional investors or smart money remain optimistic.

Source: Market Prophit