By Matthew Hayward, Senior Market Analyst at PrimeXBT

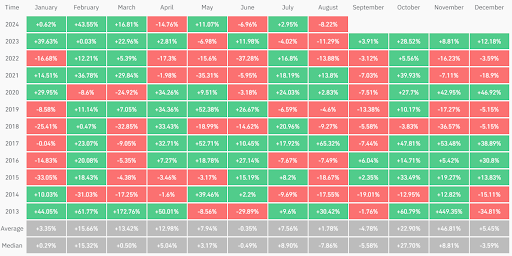

Historically, Bitcoin and the wider cryptocurrency market often face declines in September. This month typically leads to bearish trends, with Bitcoin and other cryptocurrencies displaying regular negative returns. Nonetheless, this September has been particularly active, with significant price movements influenced by changes in the macroeconomic environment and indications from central banks regarding possible policy changes. These elements have contributed to a “perfect storm” of volatility in risk assets, especially in cryptocurrencies. Data from the last ten years indicates that September frequently ranks as the least favorable month for trading Bitcoin.

Source: Crypto.ro

Bitcoin’s Seasonality and the Crypto Cycle Theory

Traditionally, Bitcoin and the larger cryptocurrency market have followed the “cycle theory,” particularly in relation to Bitcoin’s four-year halving cycle. So how does this cycle tie into current market performance? After the latest halving, we observed months of consolidation, with prices oscillating within a range and overall market sentiment remaining largely bearish. This prevailing sentiment has actively influenced present market dynamics, ensuring price stability and reflecting the cautious outlook of traders and investors during this phase of the cycle.

Source: Tradingview, Bitcoin Mathematics

Uncertainties in the Macroeconomic Landscape

The macroeconomic scene is becoming increasingly fluid, characterized by heightened uncertainty regarding central bank policies, an issue not seen in many years. This uncertainty presents crucial questions: are we heading toward a recession, or is the economy poised for continued growth? As central banks navigate challenging economic waters, the market is bracing for potential policy shifts. This environment, paired with September’s historical tendency for consolidation and reduced price movements, creates a backdrop for increased trading volume and volatility. As we approach pivotal monetary policy decisions, especially with the U.S. elections approaching, an extended period of heightened volatility in the cryptocurrency market seems likely.

Source: Reuters

Significant Moves by the FED and Interest Rate Decisions

Already this month, the Federal Reserve has surprised markets by executing a 50 basis point interest rate cut, reducing the rate from 5.5% to 5%. This unexpected action has attracted the attention of market participants, indicating a shift in monetary policy that might impact the wider economy and financial markets. Below, you can see how the total crypto market has started to trend upwards following this decision, with nearly a 10% increase since the announcement.

TOTAL CRYPTOCURRENCY MARKET CAP:

Bitcoin’s Price Action Amid Uncertainty

Despite September’s reputation as a typically weak month for Bitcoin, there are already indications of a potential breakout by the month’s end. Current price trends suggest a shift in market sentiment, indicating the possibility of sustained upward movement. This forecast aligns with Bitcoin’s halving cycle, which tends to precede bullish periods. Many analysts believe we are nearing this crucial phase, with favorable market conditions and long-term cyclical trends likely to spur a surge in Bitcoin’s price shortly.

BITCOIN (BTC/USD):

Other Significant Movements in the Cryptocurrency Market

Following the release of positive monetary policy data for risk assets, several interesting trends are emerging in the altcoin market. Solana, in particular, seems to be taking the lead, exhibiting the highest volume and momentum. Its price has risen approximately 25% this month, challenging the notion that September is generally a poor month for cryptocurrencies. This increase indicates that market dynamics may be evolving, with certain altcoins defying traditional trends and benefiting from improved economic circumstances.

Additionally, there have been significant developments, particularly with Ethereum (ETH). Despite the recent launch of the ETH ETF, the response in terms of increased volume and volatility has been somewhat delayed, unlike the immediate surge following the Bitcoin ETF launch. However, Ethereum appears to be making a comeback, with its price currently trading above the $2,500 level and showing potential for short-term gains. It will be intriguing to see if the ETH ETF eventually influences price movements as market conditions change.

How to Take Advantage of the Upcoming Economic Events

As the macro landscape evolves and uncertainty around policy adjustments and economic conditions rises, new opportunities arise. PrimeXBT, a premier online crypto and CFD broker, offers an exclusive all-in-one trading platform tailored to meet a variety of trading needs.

At PrimeXBT, you can capitalize on diverse price movements across multiple markets, including Crypto Futures and CFDs on cryptocurrencies, foreign exchange, indices, and commodities. The platform also allows trading in both crypto and fiat. With some of the lowest fees in the industry, advanced trading tools, and a wide array of asset classes, PrimeXBT equips you with everything you need to seize these economic opportunities.

Trade economic events with PrimeXBT

Disclaimer: The information provided here is for informational purposes only and should not be considered personal investment advice. Past performance is not indicative of future results. The financial products offered by the company are complex and carry a high risk of rapid loss of capital due to leverage. Virtual assets are inherently volatile and can have substantial fluctuations in value, which may lead to significant gains or losses. These products may not be appropriate for all investors. Before engaging, you should assess whether you understand how these leveraged products function and whether you can bear the high risk of losing your funds. PrimeXBT does not accept clients from Restricted Jurisdictions as indicated on its website.