Bitcoin has been progressively rising since it surpassed the $60,000 threshold and is now oscillating near the $70,000 mark, a price it hasn’t seen for several months. With market sentiment intensifying, investors are curious whether Bitcoin can muster the momentum to hit new all-time highs or if it will struggle to surpass critical resistance levels.

A Positive Sentiment

The Fear and Greed Index serves as a valuable indicator of market sentiment, reflecting traders’ perspectives on Bitcoin’s future direction. At present, the index sits at a “Greed” level around 70, historically viewed as a bullish signal, yet still some way from the extreme greed levels that may suggest a market peak. This index gauges market emotions, where lower values indicate fear and higher values indicate greed. Typically, crossing into the 90+ range signals excessive bullishness, raising concerns about a potential overextension.

It’s worth mentioning that last year, when the Fear and Greed Index reached comparable levels, Bitcoin was trading around $34,000. In the following months, it more than doubled to $73,000.

Essential Support

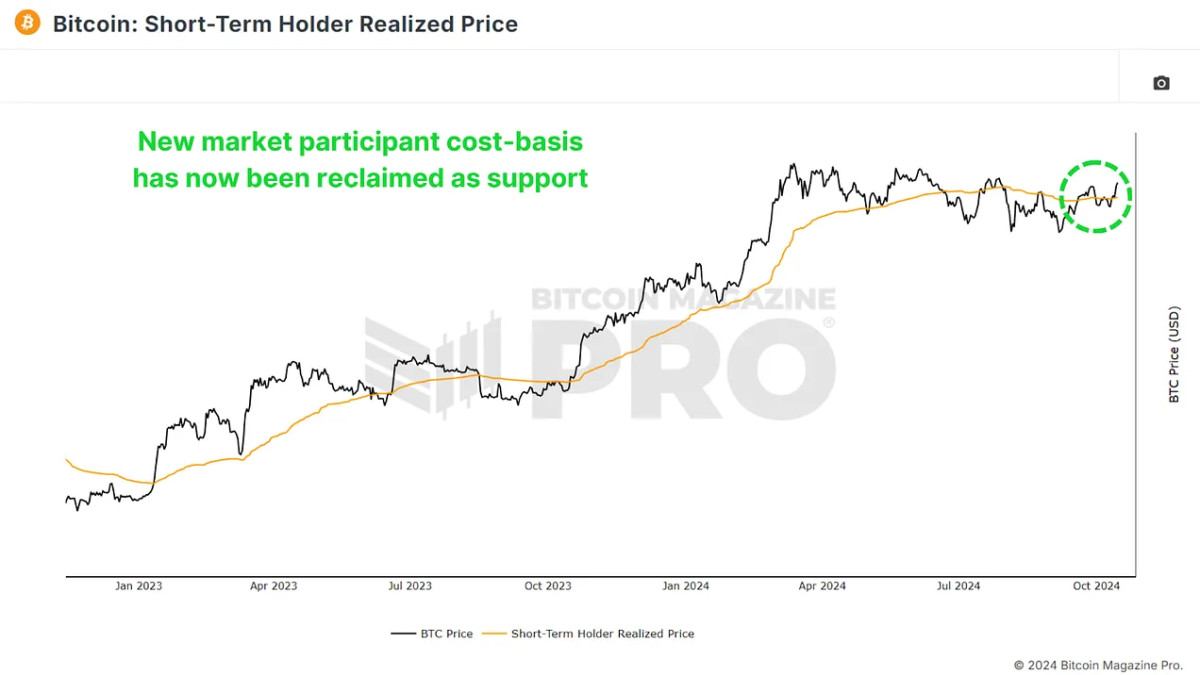

The Short-Term Holder Realized Price represents the average purchase price for recent Bitcoin investors. This metric is vital, often acting as a strong support level during bull markets and as resistance in bear markets. At the moment, this price is approximately $62,000, and Bitcoin has maintained its position above it. This is a favorable sign, indicating that newer market participants are in profit, and Bitcoin remains above a significant support zone. Historically, dropping below this level has been associated with market weakness, so preserving this support is critical for any continued upward movement.

This pattern has been observed in previous cycles, particularly during the 2016-2017 bull market, where Bitcoin retraced to this level multiple times before resuming its ascent. If this trend persists, Bitcoin’s recent advances could establish a base for further upward momentum.

Market Stabilization

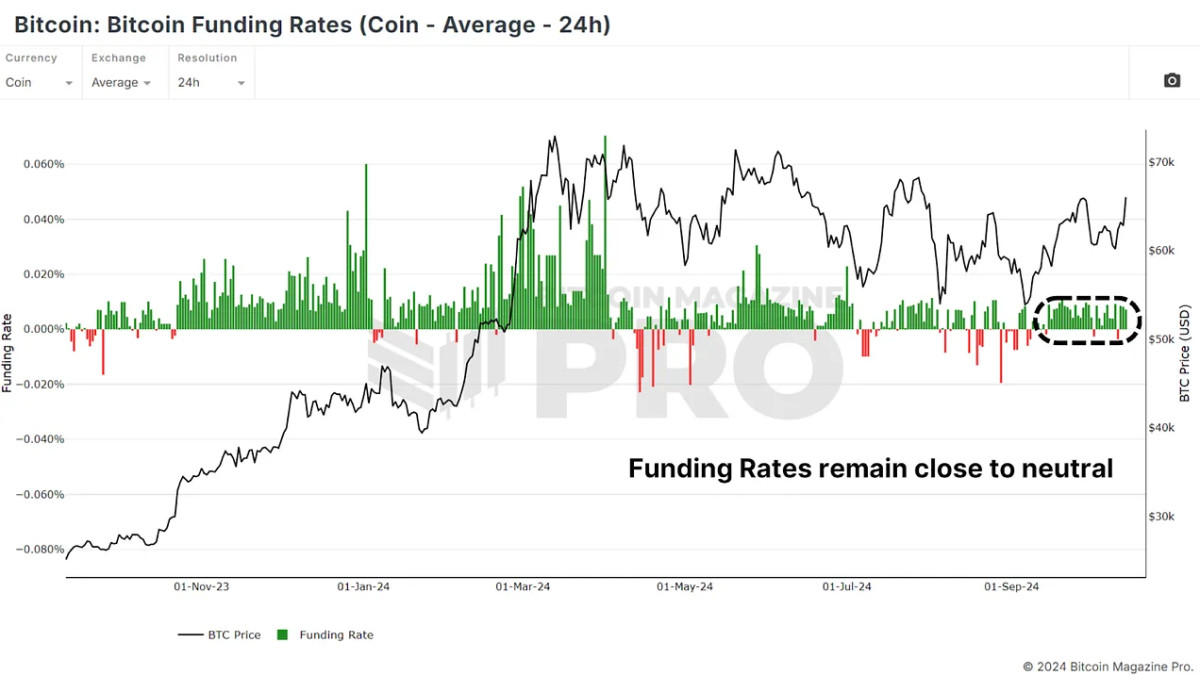

A key area traders closely monitor is the Funding Rates, which represent the cost associated with maintaining long or short positions in Bitcoin futures. In recent months, funding rates have been erratic, fluctuating between overly optimistic long positions and excessively bearish short positions. Fortunately, the market has stabilized now, with funding rates resting at neutral levels. This is a positive indication, suggesting that traders are not excessively leveraged in either direction.

In a neutral environment, the likelihood of a liquidation cascade—a common occurrence when over-leveraged positions are eliminated, leading to sharp market declines—is reduced. As long as funding rates remain stable, Bitcoin may have the space it requires to continue advancing without significant volatility.

Challenging Journey to $70,000 and Beyond

Although market sentiment and technical indicators suggest Bitcoin is in a robust position, there are still substantial resistance levels above. Initially, the current resistance trend line is one that Bitcoin has found difficult to breach. This trend line has been tested repeatedly, but each occasion has resulted in Bitcoin retreating after reaching it.

Additionally, Bitcoin confronts several more hurdles, with $70,000 being a notable level. This threshold has historically served as resistance and represents a psychological benchmark that traders are likely to monitor closely. Beyond that lies the all-time high in the range of $73,000 to $74,000. Surpassing this would signal a strong bullish trend, though it may require multiple attempts for Bitcoin to clear this barrier.

One favorable technical aspect is the recent reclaim of the 200 daily moving average, a pivotal level for investors that had previously acted as resistance for Bitcoin over the last few months.

The Macro Environment: Inflows from Institutions and ETFs

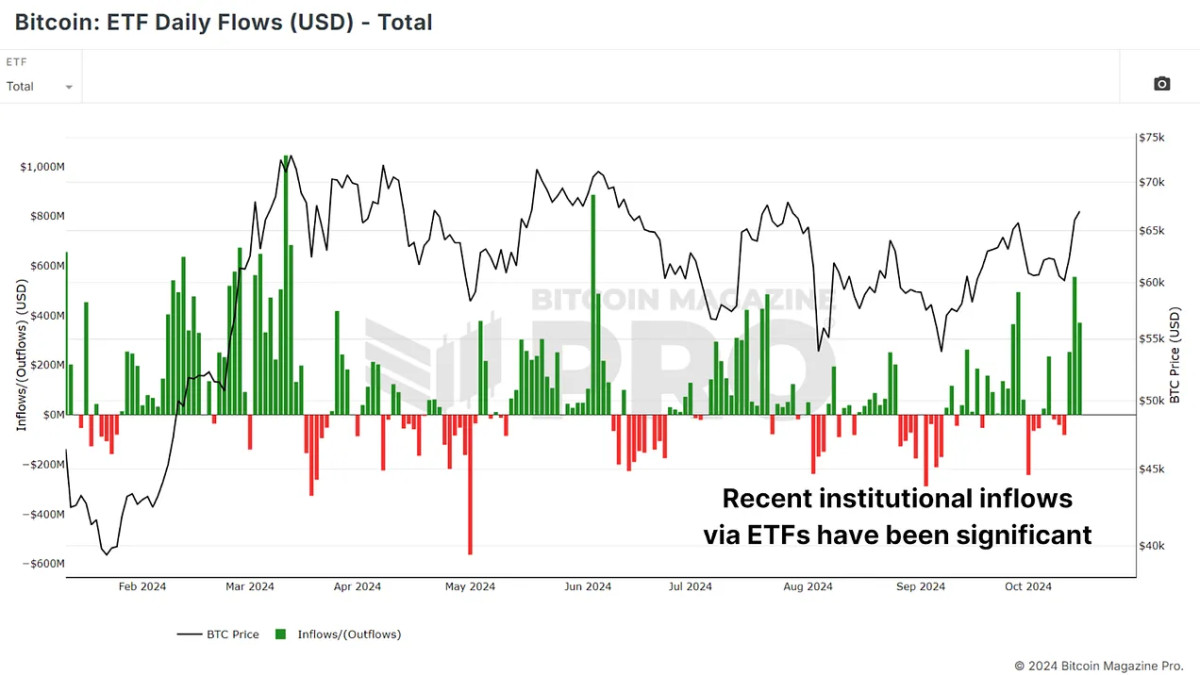

Beyond technical indicators, the macro landscape is increasingly beneficial for Bitcoin. Institutional capital continues to flow into Bitcoin Exchange-Traded Funds (ETFs). In recent days alone, over $1 billion has entered Bitcoin ETFs, indicating growing confidence in the asset. Over the previous weeks, hundreds of millions more in ETF inflows have signaled that institutional investors, in particular, are optimistic about Bitcoin’s prospects.

This is crucial because institutional investments generally adopt a long-term perspective, providing a more stable support base compared to retail speculation. Furthermore, with equities and even gold gaining traction recently, Bitcoin seems to be lagging slightly. This could create an opportunity for Bitcoin to catch up, especially if investors shift from traditional assets to the more risk-oriented landscape of Bitcoin.

Conclusion

Bitcoin’s price movements, funding rates, and overall sentiment indicate that the market is healthier than it has been in months. The influx of institutional investments into ETFs and enhancing macro conditions create additional bullish momentum. Nonetheless, significant resistance remains ahead, and any upward movement will likely encounter challenges before Bitcoin can truly break through to fresh highs.

For a more detailed examination of this subject, check out a recent YouTube video here: