Bitcoin experienced an increase of over 10% in the last week, successfully reclaiming the $60,000 price point on Friday. After an initial dip in September, this price surge from the leading cryptocurrency has sparked a wave of positive sentiment among investors. However, an analyst from Cryptoquant, known as CRYPTOHELL, warns that this bullish trend is facing challenges from conflicting forces that are directing the BTC market toward a pivotal moment.

Bitcoin Market Forces at an Impasse – What Lies Ahead?

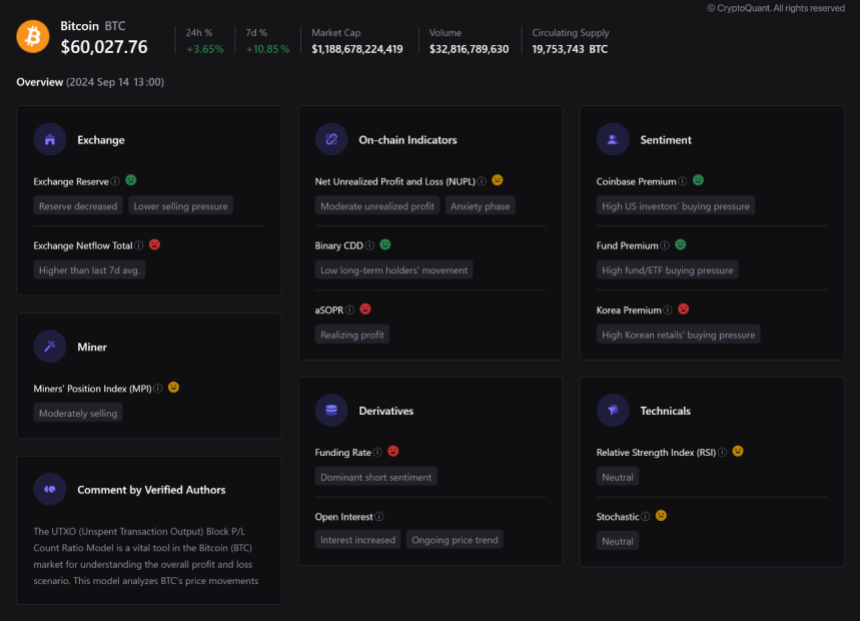

In a Quicktake post on Saturday, CRYPTOHELL pointed out that the current state of the Bitcoin market exhibits both hopeful and warning signals.

On the optimistic side, the crypto analyst observes a decline in BTC exchange reserves, suggesting reduced selling pressure as investors choose to hold their assets in expectation of future price increases. This positive outlook is reinforced by robust demand from US investors, evident in the appetite for Bitcoin spot ETFs and supported by metrics like the Coinbase Premium Index.

Conversely, CRYPTOHELL highlights certain market dynamics that may necessitate caution from investors.

First, the analyst notes a higher-than-average exchange netflows of Bitcoin over the past week, which might signal notable selling pressure. Additionally, the Adjusted Spent Output Profit Ratio (aSOPR), an important metric for gauging market sentiment, indicates a modest level of profit-taking by investors, hinting at selling pressure on Bitcoin.

Moreover, this bearish sentiment is further supported by negative funding rates in the derivatives market, which suggest that many traders are engaging in leveraged short positions anticipating a price decline.

The coexistence of these bullish and bearish factors has pushed the BTC market into a state of “anxiety,” leaving many investors uncertain about the digital asset. Nevertheless, long-term investors remain largely inactive, which bodes well for bullish dynamics.

In summary, CRYPTOHELL indicates that the Bitcoin market stands at a “decision point,” and with technical indicators reflecting a neutral stance, upcoming price movements are likely to be influenced by significant shifts in market sentiment and crucial news related to adoption and regulation.

BTC Leverage Ratio Reaches New Yearly Peak

In related news, crypto analyst Ali Martinez has reported that the total estimated leverage ratio of Bitcoin across exchanges has reached a new yearly high. This trend indicates that Bitcoin traders are embracing more risk by opening positions with borrowed funds. While leveraging can amplify potential gains, it also carries the possibility of substantial losses, potentially leading to widespread liquidations. Therefore, heightened caution in the BTC market is advised.

As of this writing, Bitcoin is trading at $60,220, reflecting a 0.23% decrease over the last day. Additionally, Bitcoin’s trading volume has dropped by 51.83% with a value of $15.74 billion.

Related Reading: Bitcoin Price Recovery Depends on This Crucial Market Indicator, Reveals Analyst