The price of Bitcoin (BTC) is currently shrouded in uncertainty as conflicting market trends and macroeconomic influences take center stage. Robust job growth may compel the Federal Reserve to lower interest rates, which could ultimately benefit Bitcoin by enhancing liquidity.

Nevertheless, the latest exchange activity exhibits a balanced interplay of inflows and outflows, suggesting a lack of definitive price direction at this moment. BTC must overcome resistance near $63,000 to gain upward momentum, while a decline below the $59,000 support level could lead to a drop to $55,000 or even lower.

Booming Job Market: A Double-Edged Sword for BTC’s Future?

The impressive job growth and market optimism present a complex scenario for Bitcoin. On one side, a positive economic outlook might diminish the urgency for investors to gravitate towards riskier assets like BTC, as traditional equities could yield safer returns in a stabilizing market.

Moreover, the Federal Reserve’s potential for a more cautious approach to interest rate cuts could fortify the U.S. dollar, diminishing Bitcoin’s allure as a hedge against inflation.

Conversely, if the economy continues to expand without overheating, it could bolster overall investor confidence, leading to an uptick in speculative investments that might favor BTC. Additionally, a slower pace of interest rate reductions could sustain high liquidity levels, which generally favors high-risk assets like Bitcoin.

In summary, while a thriving economy could temper some of Bitcoin’s appeal as a safe haven, it may still draw in investors seeking growth in a favorable market climate.

Bitcoin’s Balancing Act: Uncertain Net Exchange Flows

In the last month, net outflows from exchanges have predominantly influenced Bitcoin’s movement, yet the trend is not as straightforward as it may seem at first glance.

On September 10, a dramatic outflow occurred, hitting a monthly low of -16,000 BTC, traditionally viewed as a bullish signal since it indicates that holders are removing a substantial amount of Bitcoin from exchanges, thus lessening the supply for sales. However, subsequent movements have lacked decisiveness.

Read more: 7 Top Crypto Exchanges in the USA for Bitcoin (BTC) Trading

Despite the negative outflows predominating, indicating more outflows than inflows in general, the fluctuations haven’t been extreme, and there have been multiple instances of positive inflows. These suggest that some investors are still sending BTC to exchanges, potentially for selling purposes, further complicating market clarity.

The interplay of inflows and outflows depicts a market lacking a decisive trend. Even though there seems to be a tendency towards holding assets over selling, it’s insufficient to drive Bitcoin’s price upward with conviction.

With recent inflows and outflows balancing out, the BTC price trend remains ambiguous, and the market could easily pivot in either direction depending on future inflow and outflow patterns.

BTC Price Forecast: Could We See a 10% Upsurge Soon?

If the labor market continues to showcase robust job creation, such as the recent addition of 254,000 jobs in September, it may encourage the Federal Reserve to pursue further cuts to interest rates. Typically, a rate cut reduces borrowing expenses and infuses more liquidity into the economy, nudging investors toward riskier assets like Bitcoin in search of higher returns.

This development could positively influence BTC’s price by heightening demand, especially as lower interest rates render traditional investment avenues less appealing. Should Bitcoin succeed in breaking through critical resistance levels around $63,000 and $64,700, it might ignite a rally towards $66,000 or beyond as investors shift their attention to cryptocurrency.

Read more: Bitcoin (BTC) Price Forecast for 2024/2025/2030

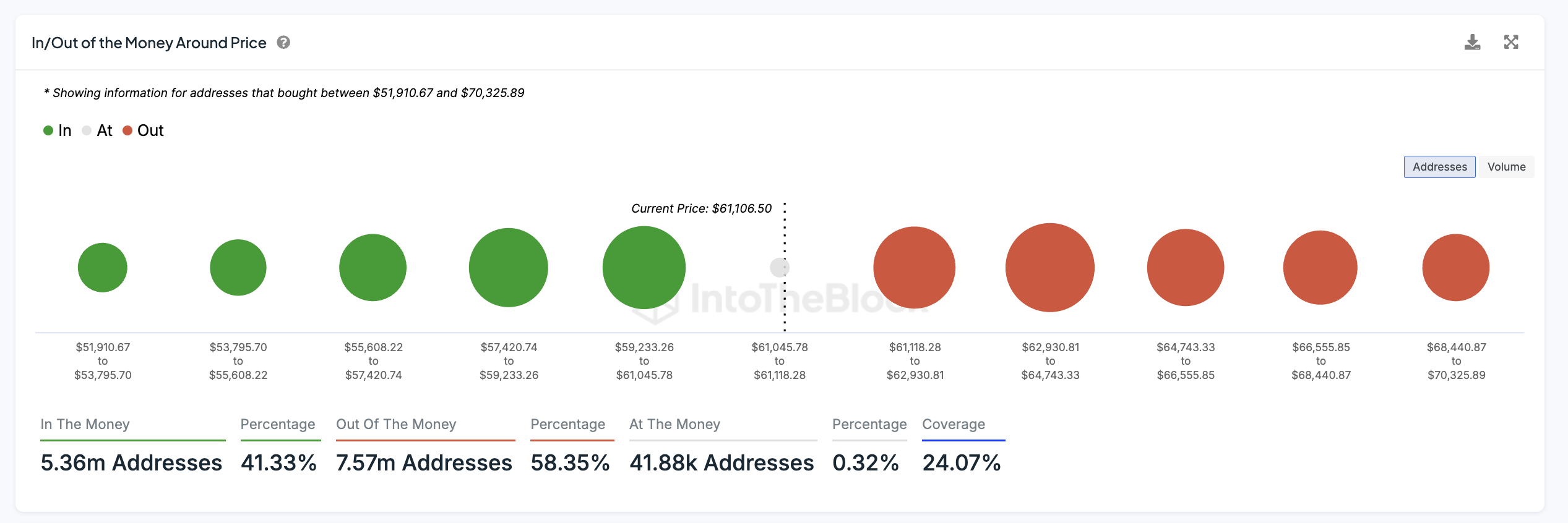

The In/Out of the Money Around Price (IOMAP) chart, which illustrates where BTC holders stand in terms of profitability, highlights significant support and resistance levels close to the current price. However, if BTC fails to sustain around $59,000, it may face a sharper downside risk.

A breach below this critical level could lead to a substantial correction, with BTC potentially descending to $55,000 or even $53,000, where additional major support levels lie. This scenario could trigger further selling pressure, particularly among traders aiming to mitigate their losses, pushing Bitcoin into a more bearish phase unless broader economic factors, such as interest rate cuts, can revive bullish sentiment.

Disclaimer

In accordance with the Trust Project guidelines, this price analysis article is intended for informational purposes only and should not be regarded as financial or investment advice. BeInCrypto is dedicated to delivering accurate, unbiased reporting; however, market conditions can change unexpectedly. Always perform your own research and consult with a professional prior to making any financial decisions. Please be aware that our Terms and Conditions, Privacy Policy, and Disclaimers have been revised.