Spot Bitcoin ETFs, or exchange-traded funds, ended a two-week outflow trend with impressive weekly inflows exceeding $403.8 million. Market analysts predict that the surge in institutional interest this year may enable Bitcoin to counter the typically bearish September narrative.

As reported by SoSoValue, spot Bitcoin ETFs experienced a significant inflow of $263.07 million on September 13, marking the highest single-day inflow since July 22, with Fidelity, ARK Invest, and 21Shares capturing over half of that day’s total.

- Fidelity’s FBTC maintained its 5-day inflow streak, receiving $102.1 million.

- ARK Invest and 21Shares’ ARKB brought in $99.3 million.

- Bitwise BITB gathered $43.1 million.

- Franklin Templeton EZBC saw $5.2 million.

- Grayscale’s GBTC recorded its first positive inflow since July 19, totaling $6.7 million.

- VanEck’s HODL had inflows of $5.1 million.

- Valkyrie’s BRRR noted $1.7 million in inflows, marking its first inflow day after a four-day dry spell.

- BlackRock’s IBIT, Invesco’s BTCO, WisdomTree’s BTCW, and Grayscale’s Bitcoin mini trust reported zero inflows.

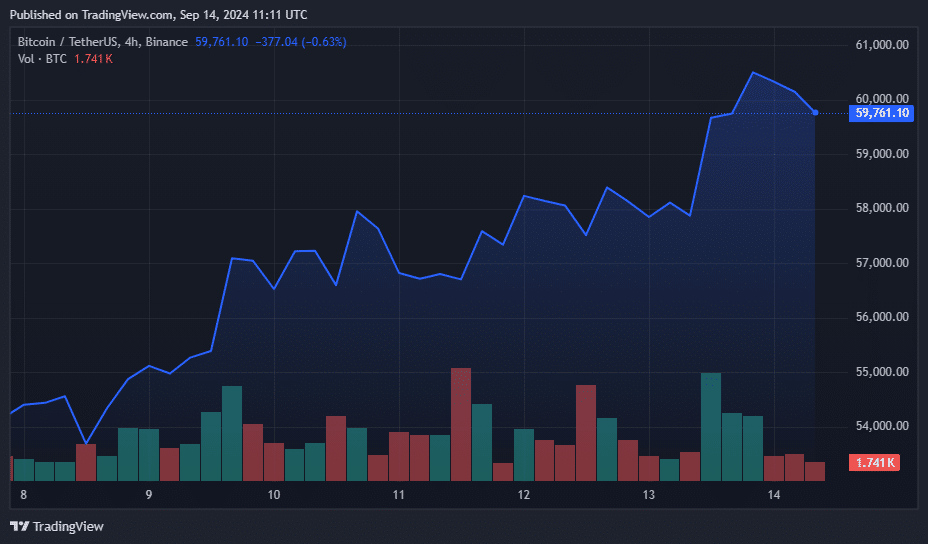

As Bitcoin (BTC) rebounded to around $60,000, Bitcoin ETFs broke out of the two-week outflow streak, reaching an intraday peak of $60,655 and a low of $57,668.

At the time of this writing, the cryptocurrency was trading 11% higher than its weekly low of $53,860 recorded on September 8.

This Time Is Different

Traditionally, September has not been kind to Bitcoin. According to CoinGlass, the average monthly loss over the past 11 years stands at 4.69%.

However, analyst Rajat Soni argues that increasing institutional interest, spurred by the approval of spot Bitcoin ETFs in this cycle, may lead to a reversal of this trend.

Soni highlighted that Bitcoin has been consolidating above the $50,000 level for the last six months, pointing out that the previous time it maintained such a position was in 2021. At that time, the market was largely influenced by retail investors who are often driven by emotions, resulting in higher volatility.

This time, Soni posits that the involvement of institutional investors might offer a more stable foundation, reducing the likelihood of Bitcoin falling below this crucial level. This sentiment has also been echoed by various industry experts interviewed by crypto.news earlier this month.

“This time is different. Institutional investors are here, and they are prepared to purchase whatever retail investors decide to sell,” Soni stated.

Despite this optimism, Soni advised caution against selling, warning that investors might end up paying significantly more to repurchase later as institutions are poised to acquire any coins made available on the market.

The surge in institutional interest also seems to be impacting Bitcoin mining stocks. Analysts at H.C. Wainwright observed that the approval of spot Bitcoin ETFs, coupled with rising demand for AI-driven power infrastructure, has heightened investor interest in Bitcoin mining equities.

This bullish outlook is further reinforced by optimistic price predictions from industry leaders, including Michaël van de Poppe, who suggests that Bitcoin could potentially reach between $300,000 and $600,000 in this market cycle.

As of the latest update, Bitcoin was trading around $59,650, reflecting a 9.7% increase over the past week.