Essential Insights

- Bitcoin and Ethereum saw substantial declines in the last 24 hours.

- The market is anticipating a more assertive 50-basis-point rate cut by the Fed.

Distribute this article

Bitcoin (BTC) declined by 3%, while Ethereum (ETH) fell by 6% within the past 24 hours, in anticipation of a pivotal week where interest rate decisions by central banks take center stage. Currently, the total crypto market capitalization stands at $2.12 trillion, reflecting a daily decrease of 4.5%.

Market volatility resurfaced as Bitcoin dipped to a low of $58,200 before bouncing back slightly to trade above $58,600, as per data from CoinGecko. Sentiment is mixed within the market, with both bullish and bearish trends vying for dominance over Bitcoin’s future trajectory.

While Bitcoin struggled, altcoins followed suit with significant declines. Over the past 24 hours, Ethereum experienced a drop of approximately 6%, settling around $2,300, while Solana (SOL), Doge (DOGE), and Ripple (XRP) also fell by about 5% each.

Among the top 100 cryptocurrencies, Injective (INJ), Internet Computer (ICP), Pepe (PEPE), and Ondo (ONDO) showed the largest average losses, around 7%, according to current data.

The crypto landscape is poised for further fluctuations as the Federal Reserve’s (Fed) interest rate decision looms. Economists caution that a 25-basis-point rate cut could lead to a “sell-the-news” phenomenon, given that the market has largely incorporated this adjustment already.

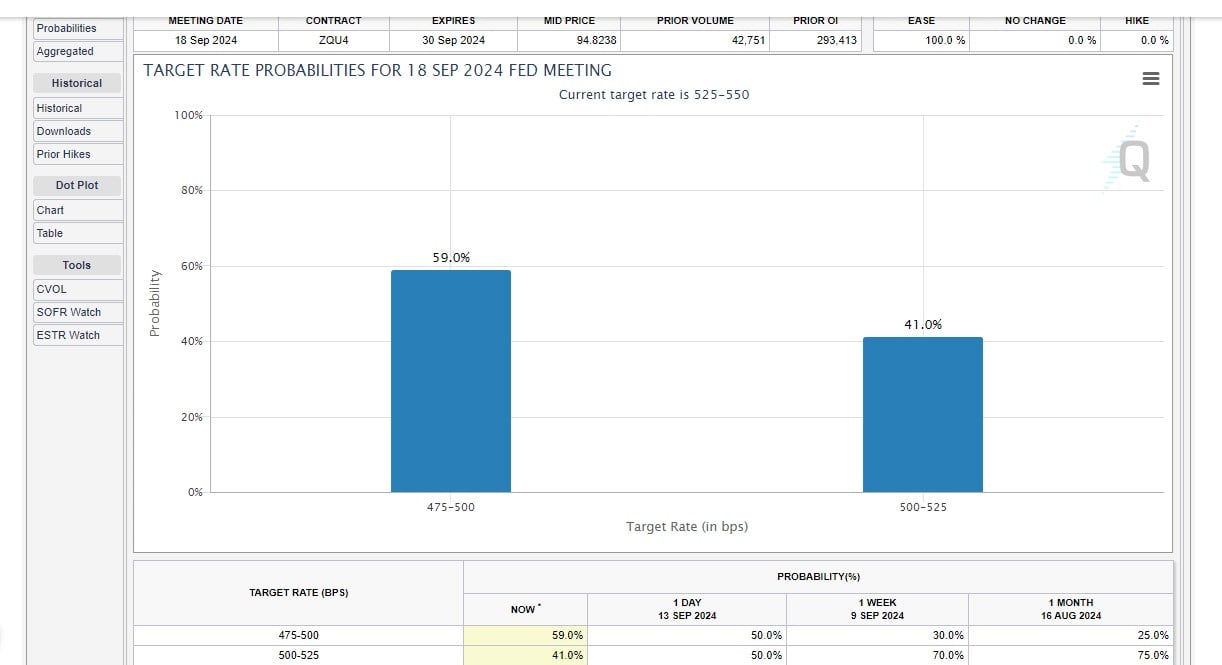

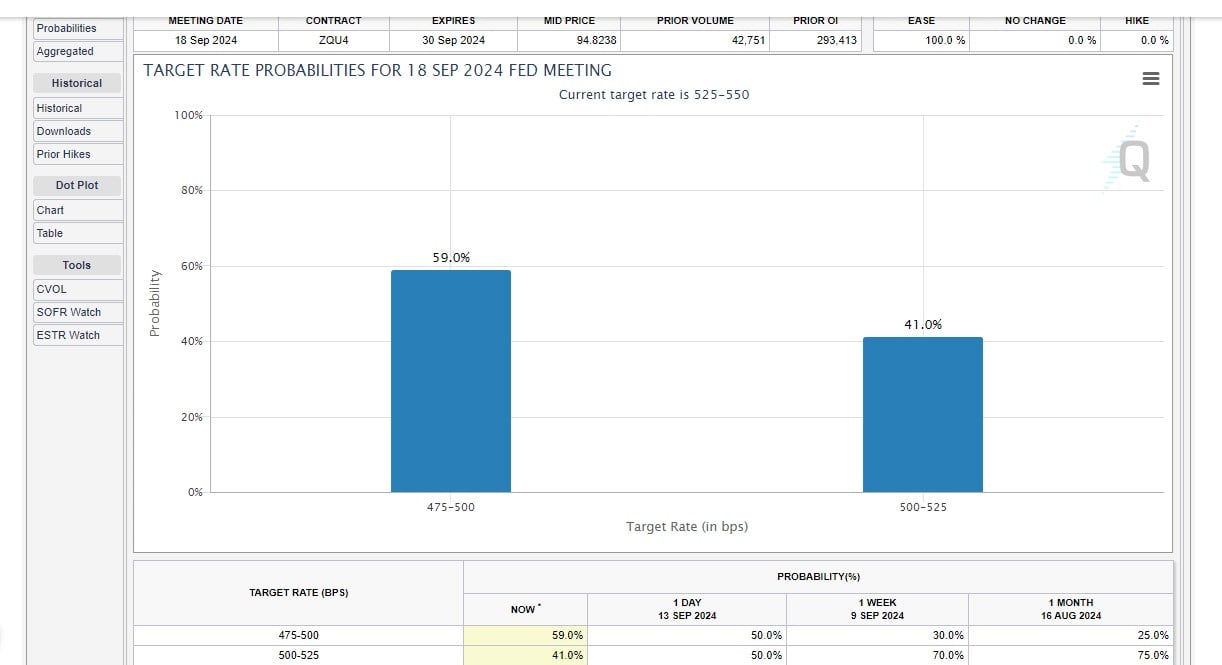

Market sentiment surrounding the Fed’s upcoming interest rate decision has shifted noticeably. The CME FedWatch tool indicates a 41% likelihood of a 25-basis-point cut and a 59% chance of a more substantial 50-basis-point reduction.

The probability for the latter option was only 30% last week and was equal to the chances for a 25-basis-point cut just yesterday.

Market observers seem to favor a 50-basis-point cut. In this context, economist predictions are varied.

Economist Steve Hanke from Johns Hopkins University noted to The Block that a 50-basis-point reduction could invigorate the crypto market.

“…a 50-basis-point cut is not factored in. If it were to occur, it would likely provide a boost to the market,” he stated.

Nonetheless, an aggressive cut may signal economic challenges, potentially dampening positive feelings about rate reductions. According to 21Shares research analyst Leena ElDeeb, an impending recession could incite sell-offs across “risk-on assets in the short term.”

The Fed’s decision is anticipated on Wednesday, September 18. A rate reduction would reverse the tightening cycle initiated in 2022 and represent the first cut since 2020.

In addition to the US central bank, attention is also directed toward interest rate decisions from the Bank of England and the Bank of Japan.

The Bank of England plans to announce its next rate decision on September 19, following its recent rate cut from 5.25% to 5% on August 1, the first reduction since the beginning of the tightening cycle in late 2021.

Monetary policy committee members are closely monitoring inflation persistence, even as it has been brought down to target levels.

The Bank of Japan will also unveil its interest rate decision on September 19, a meeting that’s closely watched as the bank has sustained a restrictive monetary policy for years, including negative interest rates and yield curve control measures.